Understanding Wildfire Smoke Damage Claims: What You Need to Know

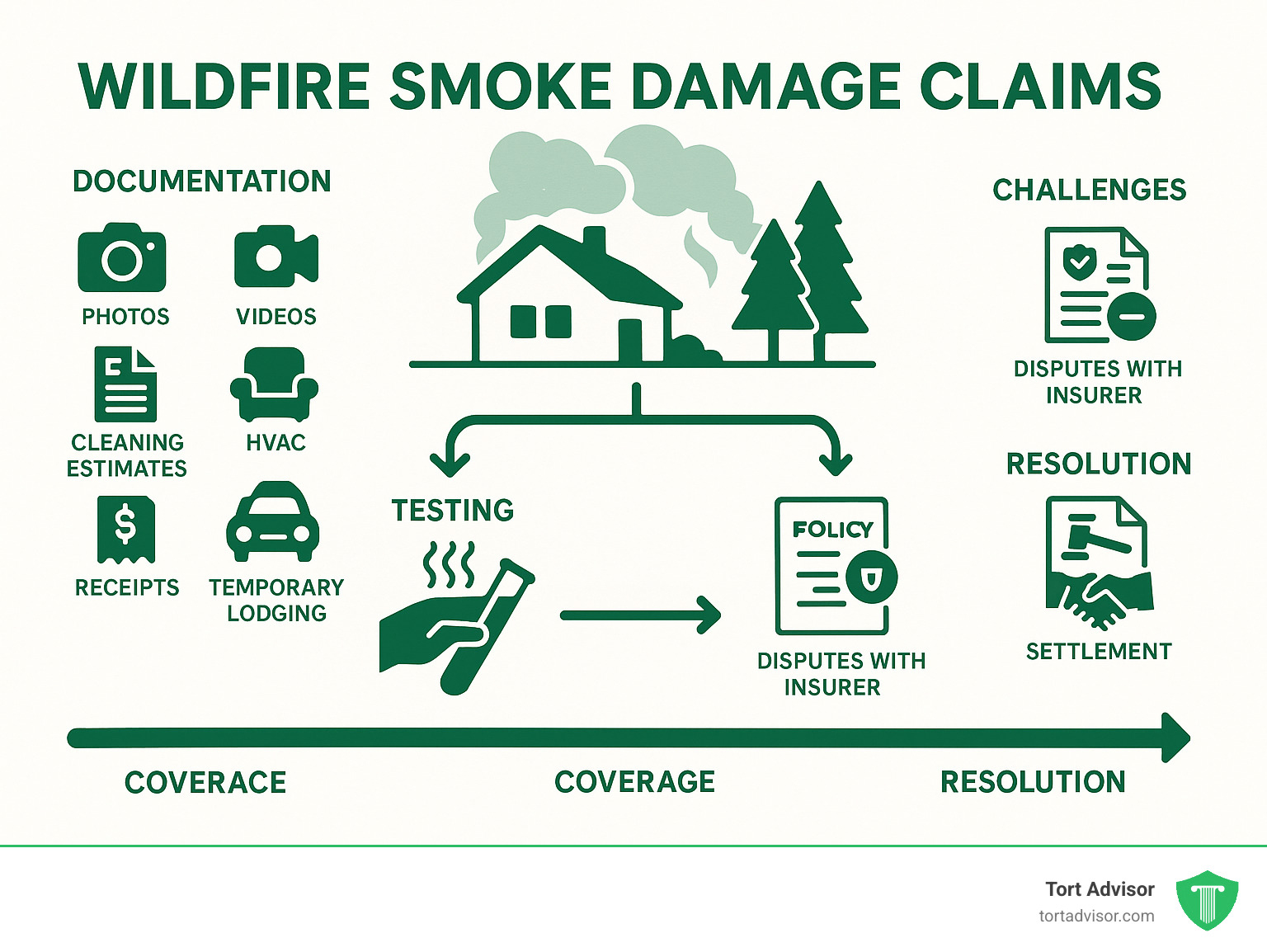

Wildfire smoke damage claims are insurance claims filed to recover costs for property damage caused by smoke, soot, and ash from wildfires, even when no direct fire damage occurs. Here’s what you need to know:

- Who can file: Homeowners, renters, business owners, vehicle owners, and evacuees

- What’s covered: Structure cleaning, content restoration, HVAC systems, electronics, vehicles, landscaping, and temporary housing

- Documentation needed: Photos, videos, professional testing reports, cleaning estimates, and receipts

- Typical timeline: File within 10-30 days of finding damage (varies by policy)

- Average costs: Professional testing ($2,000-$4,000), remediation (hundreds to six figures)

When wildfires tear through communities, the destruction extends far beyond the flames. Even homes miles away can suffer significant smoke damage, requiring extensive cleaning and restoration. As California’s Department of Insurance reported in 2025, more than 33,000 wildfire-related insurance claims were filed, with many homeowners finding their insurers significantly undervalued smoke damage repairs.

Smoke damage is insidious. It seeps into every corner of your home, leaving behind toxic residue that can corrode electronics, stain surfaces, contaminate air systems, and create lingering health hazards.

My name is Mason Arnao, and throughout my career in technology and data management, I’ve helped countless clients steer wildfire smoke damage claims by documenting and validating their losses through comprehensive data collection and analysis systems.

Eligibility & Coverage Basics

When smoke from a wildfire invades your home, it creates a different kind of damage than actual flames. Understanding this difference is key to getting your insurance claim handled properly. Smoke damage happens when soot, ash, and odors work their way into your property—even if you never saw a single flame nearby.

For wildfire smoke damage claims to be successful, you’ll need to prove “direct physical loss” to your property. California’s Insurance Bulletin 2025-7 makes this clear: smoke damage counts as direct physical loss even when the damage isn’t immediately visible.

| Smoke Damage | Fire Damage |

|---|---|

| Often invisible or subtle | Visibly apparent destruction |

| May affect properties miles from fire | Directly impacts burned structures |

| Requires specialized testing | Obvious physical evidence |

| Frequently disputed by insurers | Rarely questioned as covered loss |

| Often undervalued in estimates | More straightforward valuation |

Who Can File Wildfire Smoke Damage Claims?

Homeowners can file claims even when their house looks fine from the outside. Those tiny smoke particles work their way into walls, HVAC systems, and personal belongings.

If you’re a renter, your renters insurance should cover cleaning or replacing your smoke-damaged belongings while your landlord handles the building itself.

Small business owners aren’t left out either. Most business owners policies cover smoke damage to your commercial building, equipment, and inventory. Business interruption coverage can help replace lost income.

Vehicle owners with comprehensive auto coverage can typically file claims for exterior paint damage, interior contamination, and mechanical issues caused by smoke and ash.

Even if you were just evacuated and your property escaped damage, you might still have coverage. Many policies include Additional Living Expenses (ALE) provisions that help with hotel bills and meals when you’re forced to leave home.

Types of Losses Covered

Your home’s structure often needs attention—from cleaning smoke-stained walls and ceilings to replacing contaminated insulation and HVAC systems.

Your personal contents like furniture, clothing, and electronics often suffer the most visible damage. Restoration specialists can sometimes clean these items, but many need replacement when smoke damage is severe.

Your landscaping may also have coverage, though it’s often limited (typically around $500 per tree) for vegetation damaged by smoke, ash, or fire retardants.

If your home becomes temporarily uninhabitable, Additional Living Expenses coverage kicks in to help with hotel stays, restaurant meals, and other costs while you’re displaced.

Business owners facing smoke damage can claim business interruption coverage for lost income and ongoing expenses while repairs take place.

Filing Wildfire Smoke Damage Claims

When it comes to filing wildfire smoke damage claims, attention to detail makes all the difference between a successful recovery and a frustrating denial.

Most policies require you to contact your insurance company within 10-30 days of finding damage. Begin by reviewing your policy—understanding your coverage limits, deductibles, and specific requirements will help you steer the process with confidence.

Documentation is your best ally. Before touching anything, take extensive photos and videos of all affected areas. These images become your “before” evidence. Next, consider hiring a Certified Industrial Hygienist (CIH) for professional testing. Their written report carries significant weight with insurers who might otherwise dismiss invisible damage.

Create a detailed inventory of damaged items with descriptions, purchase dates, and replacement costs. Submit your claim along with the proof of loss form your insurer provides.

Keep meticulous records of all expenses—from temporary housing and meals to cleaning supplies. These costs may be reimbursable under your Additional Living Expenses coverage.

Essential Documentation for Wildfire Smoke Damage Claims

The strength of your claim lies in your evidence. Start with clear photos and videos that capture every affected area. Close-ups of soot deposits and discoloration tell a story that words alone cannot convey.

Simple swipe tests using white gloves or alcohol wipes on horizontal surfaces demonstrate soot presence in a tangible way. One homeowner I worked with used this method to document contamination in rooms that appeared clean—resulting in coverage for remediation that would have otherwise been denied.

Professional testing represents your most compelling evidence. A qualified CIH can conduct surface sampling, air sampling, and laboratory analysis that scientifically validates the presence and extent of smoke damage. Their written remediation protocols also provide a roadmap for proper restoration.

Immediate Post-Smoke Action Checklist

When wildfire smoke invades your home, taking swift action protects both your health and your claim’s viability:

- Prioritize safety first—wear N95 masks during inspections

- Change your HVAC filters immediately to prevent recirculating contaminants

- Deploy portable HEPA air cleaners in living spaces

- Keep windows closed if outdoor air quality remains poor

- Preserve evidence—resist discarding damaged items until an adjuster has inspected them

- Contact your insurer promptly

- Document pre-cleaning conditions thoroughly

At Tort Advisor, we understand the complexity of these claims and can connect you with attorneys who specialize in holding insurers accountable. Learn more about our wildfire lawsuit services if you’re facing resistance from your insurance company.

Inside the Insurance Process

Understanding how insurance companies handle wildfire smoke damage claims can help you steer the process more effectively.

When you file a claim, your insurance company typically assigns an adjuster to inspect your property. But these adjusters often lack specialized training in smoke damage assessment, which can lead to your claim being significantly undervalued.

State Farm has an agreement with ServPro that provides on-site cleaning for smoke-damaged contents at roughly $4 per square foot—a rate widely considered insufficient for thorough restoration. It’s a one-size-fits-all approach that doesn’t account for how deeply smoke can penetrate different materials.

There is good news for California residents. In March 2025, the Department of Insurance issued Bulletin 2025-7, which reinforces that smoke damage qualifies as “direct physical loss or damage,” giving homeowners stronger ground when challenging unfair claim denials.

In February 2025, out of 33,717 wildfire-related insurance claims filed in California, 19,854 were partially paid, totaling $6.9 billion. But many of these partial payments were initial lowball offers that fall far short of covering full remediation costs.

How Insurance Companies Evaluate Smoke Damage

When your insurer evaluates smoke damage, they typically follow a process that often misses crucial damage:

- An adjuster performs an initial inspection, visually examining your property for obvious signs

- They might conduct basic surface testing – simple swipe tests checking for soot

- Next comes damage categorization into visible damage, odor-related damage, and hidden damage

- They develop a remediation plan that frequently favors surface cleaning over comprehensive remediation

- Finally, they provide a cost estimation using standardized rates that rarely reflect true expenses

The fundamental issue is the distinction between visible and invisible damage. An adjuster can see soot on walls, but they can’t visually detect smoke particles that have penetrated porous materials. This invisible damage is why professional testing by a Certified Industrial Hygienist becomes crucial.

Common Reasons Claims Are Denied or Underpaid

Insurance companies have developed several tactics to deny or undervalue claims:

- The “no visible destruction” argument – claiming that without visible damage, there’s no covered loss

- The pre-existing conditions approach – attributing discoloration or odors to normal wear and tear

- Inadequate testing – relying solely on visual inspections rather than scientific testing

- Cleaning vs. replacement disputes – insisting that cleaning is sufficient when replacement is necessary

- Undervalued estimates – in one case we documented, an insurer’s initial estimate was $42,000, while the actual cost determined by independent experts came to $300,000

- Policy misinterpretation – incorrectly applying policy exclusions or limitations

- Unreasonable deadlines – pressuring you to accept quick settlements before you’ve found the full extent of damage

Maximizing Recovery & Protecting Health

Securing fair compensation while protecting your family’s health requires a strategic approach to remediation and recovery.

When the smoke clears, you’re faced with a crucial decision: clean or replace? While your insurance company will typically push for cleaning (the cheaper option), replacement is often necessary for health and safety.

Porous items like sofas and mattresses absorb smoke particles. Electronics with internal smoke damage could fail months later if not properly addressed. Many families accept quick cleaning solutions only to find lingering odors and health issues weeks later.

Investing in professional testing is worth every penny. Comprehensive smoke testing typically costs between $2,000-$4,000, but this investment often leads to settlements tens of thousands of dollars higher by documenting what the naked eye can’t see.

Role of Independent Experts

When facing the insurance goliath, having your own team of experts makes all the difference:

Public adjusters are your personal claim advocates who represent your interests exclusively. They typically charge 10-15% of your settlement, but their expertise often results in significantly higher payouts that more than offset their fee.

Certified Industrial Hygienists (CIHs) bring science to your side. With specialized equipment, they collect surface and air samples, analyze smoke particulates, and document harmful compounds lurking in your home. Most importantly, they develop detailed remediation protocols.

When selecting restoration contractors, look beyond the lowest bid to find professionals with IICRC certification in fire and smoke restoration and specific wildfire experience.

Sometimes, despite your best efforts, you’ll need legal counsel. Attorneys specializing in insurance claims can challenge denials, address bad faith practices, and when necessary, take your case to court.

Health Risks & Medical Coverage

Wildfire smoke leaves behind an invisible toxic soup that poses serious health risks:

- PM2.5 particles can penetrate deep into your lungs

- Polycyclic Aromatic Hydrocarbons (PAHs) bring carcinogenic compounds into your home

- Volatile Organic Compounds (VOCs) cause throat and eye irritation

- Heavy metals and asbestos may be present if nearby structures burned

The health effects range from immediate symptoms like coughing to long-term risks of respiratory and cardiovascular diseases. Children, elderly family members, and those with pre-existing conditions are particularly vulnerable.

While most property insurance policies don’t directly cover medical expenses, you can often recover health-related costs indirectly through coverage for temporary housing, professional cleaning, and HVAC system restoration.

For ongoing protection, consider investing in certified air cleaners. The California Air Resources Board maintains a list of certified air cleaners that effectively reduce indoor particulate matter.

For more comprehensive assistance with wildfire-related legal matters, visit our wildfire lawsuit services page.

Legal Rights, Deadlines & Dispute Resolution

When facing challenges with your wildfire smoke damage claim, understanding your legal rights and dispute resolution options is essential.

Your insurance policy is a binding contract. Your insurer has a legal obligation to handle your claim in good faith, and when they don’t play fair, you have options.

California residents have particularly strong protections. Insurance Code section 790.03(h) requires insurers to conduct thorough, fair investigations. The March 2025 California Department of Insurance Bulletin 2025-7 explicitly states that smoke damage qualifies as “direct physical loss or damage.”

Time is of the essence. Most states, including California, give you a two-year window to file lawsuits related to insurance disputes. But your specific policy might have much shorter deadlines for certain actions.

How to Dispute a Denied Wildfire Smoke Damage Claim

If you’ve received a denial letter or inadequate settlement offer, you have several paths forward:

- Start with an internal appeal by requesting a formal review from a different adjuster or supervisor

- Consider filing a Department of Insurance complaint (in California: 800-927-4357 or online)

- Use the appraisal clause in your policy, where independent appraisers assess the damage

- Try mediation with a neutral third party facilitating settlement discussions

- Hire a licensed public adjuster to reopen negotiations

- When all else fails, pursue legal action

At Tort Advisor, we connect homeowners with attorneys who specialize in challenging denied claims. These legal experts understand both the science behind smoke damage and insurance law nuances.

Statutes of Limitations & Key Timeframes

Meeting deadlines is crucial when handling your claim:

- Initial claim notification: Required within 10-30 days after finding damage

- Proof of loss form: Typically due within 60 days of the insurer’s request

- Additional Living Expenses (ALE): Coverage typically lasts 12-24 months (extended to 36 months for recent California wildfire victims)

- Supplemental claims: Submit immediately as you find additional damage

- Litigation filing deadlines: Generally two years from the date of loss or claim denial

- Department of Insurance complaints: No strict deadline, but filing within a year yields better results

Throughout this process, keep meticulous records of all communications with your insurer. A detailed log of interactions can prove invaluable if your dispute escalates.

Frequently Asked Questions about Wildfire Smoke Damage Claims

What documentation will my insurer accept as “direct physical loss”?

When dealing with wildfire smoke damage claims, proving that smoke actually caused damage requires solid evidence:

- Professional testing reports from Certified Industrial Hygienists showing smoke particles, soot, or ash in your home

- Visual evidence including clear photographs showing soot deposits or discoloration

- Documented odor that persists despite cleaning attempts

- HVAC system evidence like discolored filters or test samples from your ducts

California homeowners benefit from Insurance Bulletin 2025-7, which explicitly states that smoke damage qualifies as “direct physical loss” even when not immediately visible.

How long do I have to file my smoke damage claim?

Timing matters tremendously with these claims:

- Initial notification: Most policies require you to notify your insurance company within 10-30 days of finding smoke damage

- Proof of loss: You typically have about 60 days to submit this formal documentation

- Supplemental claims: You can usually file these as you find additional damage

- Lawsuit filing: In California and many states, you generally have two years from the date of loss or claim denial

File as soon as possible. Early reporting satisfies policy requirements and allows for more accurate documentation before cleaning begins.

Will my policy pay for professional testing and cleaning?

Most standard homeowners policies should cover professional testing and cleaning, though you might need to push back:

- Professional inspection and testing ($2,000-$4,000) should be covered as part of the claim investigation

- HVAC system cleaning is typically covered when contaminated by smoke

- Contents cleaning is generally covered, though debates often arise about whether items should be cleaned or replaced

If your insurer refuses to pay for necessary testing or cleaning, request the denial in writing, file a complaint with your state’s Department of Insurance, and consider consulting with a public adjuster or attorney.

Conclusion

Navigating wildfire smoke damage claims requires persistence, documentation, and often expert assistance. Smoke damage is far more complex and potentially costly than many insurers acknowledge, from invisible particulates that penetrate building materials to the long-term health effects of toxic residue.

The statistics are telling: with insurers often undervaluing smoke damage repairs by hundreds of thousands of dollars, policyholders need to be vigilant advocates for fair compensation. The gap between an insurer’s initial offer of $42,000 and the actual remediation cost of $300,000 in one documented case illustrates just how significant this disparity can be.

At Tort Advisor, we understand the challenges you face. We connect clients with attorneys who specialize in wildfire smoke damage claims across all 50 states. These legal experts understand both the science of smoke damage and the intricacies of insurance law, and they work on a contingency basis—meaning you pay nothing unless they secure compensation for you.

If your wildfire smoke damage claim has been denied, underpaid, or is meeting resistance from your insurer, don’t fight this battle alone. Our network of experienced attorneys can help you document your loss properly, challenge unfair claim decisions, and pursue the full compensation you deserve.

For more information about how we can connect you with specialized legal help for your wildfire claim, contact us today for a free consultation. Remember: thorough documentation, expert assessment, and professional advocacy are your best tools for turning smoke signals into fair compensation.

Free Confidential Case Evaluation

Complete the short form below to get an immediate FREE case review with an expert in your specific claim. Don't wait, your case could be time sensitive to file a claim.

Related Posts

Discover New Jersey disability benefits: TDI, FLI, SSDI, SSI rates, eligibility, applications & appeals for 2025-2026.

Hire a Depo-Provera lawsuit attorney now. Fight Pfizer for meningioma risks from injections. Free consult, MDL updates & settlements up to $1.5M.

Find top Miami florida car accident lawyers after your 305 crash. Get max compensation, navigate no-fault laws & choose the best experts now!

Diagnosed with cancer after Roundup? Learn about the monsanto roundup lawsuits, eligibility criteria, and how to pursue your claim.

Discover how do you qualify for a hair relaxer lawsuit: criteria, diagnoses, evidence & brands in uterine cancer MDL. Claim review now!

Find the best uber sexual assault lawsuit lawyer: expert guides, MDL experience, proven results & nationwide firms for justice.