Understanding Your Path to SSDI Benefits

SSDI benefits qualifications have two core requirements: a sufficient work history and a qualifying medical condition. You must have earned enough work credits by paying Social Security taxes, and your disability must prevent you from performing substantial gainful activity for at least 12 months or be expected to result in death.

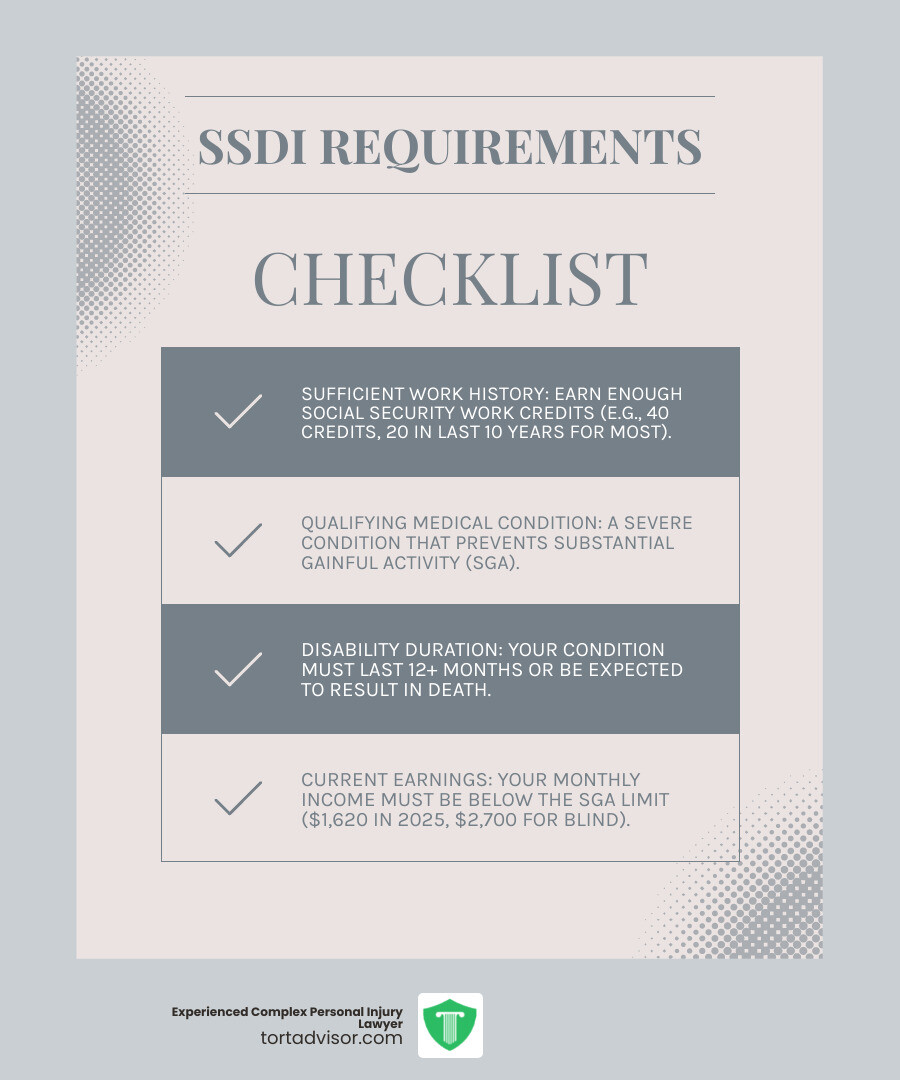

Quick Qualification Checklist:

- Work Credits: Generally need 40 credits (20 earned in the last 10 years)

- Current Work Status: Monthly earnings must be below $1,620 ($2,700 if blind) in 2025

- Medical Condition: Must prevent substantial gainful activity

- Duration: Condition expected to last 12+ months or result in death

- Age Factor: Younger workers may need fewer credits

The reality is sobering: a 20-year-old worker has a 1-in-4 chance of becoming disabled before retirement age, yet nearly 70% of initial disability claims are rejected. Understanding the rules is critical to protecting your financial future.

The Social Security Administration (SSA) uses a strict, five-step process and does not pay for partial or short-term disability. Your condition must completely prevent you from engaging in substantial gainful activity.

If you meet the criteria, SSDI provides monthly payments, eventual Medicare coverage, and potential benefits for your family. The challenge is navigating the complex application process, which requires detailed medical and work history documentation.

This guide will walk you through the requirements you need to meet.

Simple guide to SSDI benefits qualifications:

- Denied disability claim

- Disability claim assistance

- how to claim social security disability insurance arkansas

The Two Pillars of SSDI Eligibility: Work and Medical History

The Social Security Administration (SSA) evaluates two distinct parts of your situation: your work history and your medical condition. You must meet both requirements to qualify for SSDI benefits qualifications.

Work History and Your SSDI Benefits Qualifications

SSDI is an insurance benefit you earn by paying Social Security taxes. The SSA tracks this with work credits. In 2025, you earn one credit for every $1,810 in income, up to four credits per year (for earnings of $7,240 or more). That amount typically increases annually.

Most people need 40 credits total to qualify. Critically, those credits must be recent. The “20/40 rule” requires that 20 of your credits were earned in the 10 years immediately before your disability began. This recent work test ensures benefits go to those who were actively contributing.

Younger workers need fewer credits, as they’ve had less time to work:

- Under 24: Need 6 credits earned in the three years before disability started.

- Ages 24-31: Need credits for working half the time between age 21 and the date of disability.

- 31 or older: The standard 20/40 rule applies.

These exceptions recognize that a disability can strike at any age. To see your specific status, you should check your work credit status online through your Social Security account. Once you know your credit count, our SSDI Benefit Calculator can help estimate your potential monthly benefit.

Understanding the Medical Side of SSDI Benefits Qualifications

The SSA’s definition of disability is strict and is a common reason for denial. The SSA only recognizes total disability. Your condition must prevent substantial work for at least 12 consecutive months or be expected to result in death. It’s not about whether you can do your old job, but whether you can do any job that exists in the national economy.

Your condition must severely limit basic work activities like lifting, standing, walking, sitting, or remembering. While the SSA maintains a list of medical conditions (the Blue Book), your condition doesn’t have to be on it to qualify if it’s equally severe.

The most common qualifying conditions involve musculoskeletal issues (e.g., severe arthritis, spinal disorders), mental disorders (e.g., severe depression, bipolar disorder), and cardiovascular conditions (e.g., heart failure). Other categories include cancers, neurological disorders, and respiratory illnesses.

What matters most are your functional limitations. Your medical records must clearly document what you can and cannot do. Detailed evidence from doctors, including test results and statements about your limitations, is critical to building a strong case and meeting the medical SSDI benefits qualifications.

How the SSA Determines Your SSDI Benefits Qualifications

The SSA uses a 5-Step Sequential Evaluation Process to determine if you meet SSDI benefits qualifications. Your state’s Disability Determination Services (DDS) reviews your application, acting as a series of gates you must pass through for approval. If your claim is stopped at any step, it will be denied.

Step 1 & 2: Are You Working and Is Your Condition “Severe”?

These first steps filter out claims that don’t meet basic criteria.

Step 1: Are you working? If you are working and your earnings are above the Substantial Gainful Activity (SGA) limit, the SSA will find you are not disabled. For 2025, the SGA limit is $1,620 per month ($2,700 if you are blind). Exceeding this amount will lead to a denial, regardless of your medical condition.

Step 2: Is your condition severe? If you are not working above the SGA limit, the SSA determines if your condition is “severe.” This means it must significantly limit your ability to perform basic work activities (lifting, standing, sitting, remembering) for at least 12 months. If it doesn’t, your claim is denied.

Step 3, 4, & 5: Medical Listings and Your Ability to Work

If you pass the first two steps, the review becomes more detailed.

Step 3: Does your condition match a listed impairment? The SSA checks if your condition meets or equals a listing in their Blue Book. These conditions are considered so severe they automatically qualify you as disabled. An approval at this stage skips the next two steps.

Step 4: Can you still do your previous work? If your condition doesn’t meet a listing, the SSA determines your Residual Functional Capacity (RFC)—what you can still do despite your limitations. If your RFC allows you to perform any of your past relevant work from the last 15 years, your claim is denied.

Step 5: Can you adjust to other work? If you cannot do your past work, the SSA decides if you can perform any other work that exists in the national economy. They consider your age, education, and transferable skills. If the SSA finds you can adjust to other work, your claim is denied. If not, you are approved.

To speed up the process for the most severe cases, the SSA uses Compassionate Allowances and Quick Disability Determinations to flag and expedite claims for conditions like ALS or acute leukemia, allowing for approval in weeks or even days.

Navigating the SSDI Application and Appeals Process

Understanding your SSDI benefits qualifications is the first step; navigating the application is the next. Knowing what to expect can reduce stress.

How to Apply for SSDI Benefits

You have three options to apply: apply for benefits online, call the SSA at 1-800-772-1213, or visit a local office (call ahead for an appointment). Before you start, gather your documents. The SSA application checklist outlines what you’ll need, including:

- Medical Records: Contact information for all doctors and hospitals, treatment dates, and a list of medications.

- Work History: A list of employers and job duties for the past 15 years.

- Personal Information: Social Security number, birth certificate, and bank details for direct deposit.

Be aware of the five-month waiting period. Even after approval, your first payment is for the sixth full month after your disability began.

What to Do If Your Disability Claim is Denied

Most initial applications are denied, but a denial is not the final word. You have the right to appeal through a four-level process, where approval chances often increase.

- Reconsideration: A new examiner at the DDS reviews your file and any new evidence. Most claims are denied again here, but it’s a required step.

- Hearing by an Administrative Law Judge (ALJ): This is your chance to present your case in person and is often the best opportunity for approval. Legal representation is highly beneficial at this stage.

- Appeals Council: If the ALJ denies your claim, you can ask the Appeals Council to review the decision. They may deny the review, send it back to an ALJ, or issue their own decision.

- Federal Court Review: The final step is to file a lawsuit in federal district court.

The appeals process takes time, but it significantly increases your chances of success. If you’ve been denied, learn how you can appeal a decision and consider seeking guidance for your denied disability claim.

SSDI vs. SSI and Other Key Considerations

When you’re exploring disability benefits, you’ll encounter two programs: SSDI and SSI. It’s easy to mix them up, but they serve different populations and have different SSDI benefits qualifications.

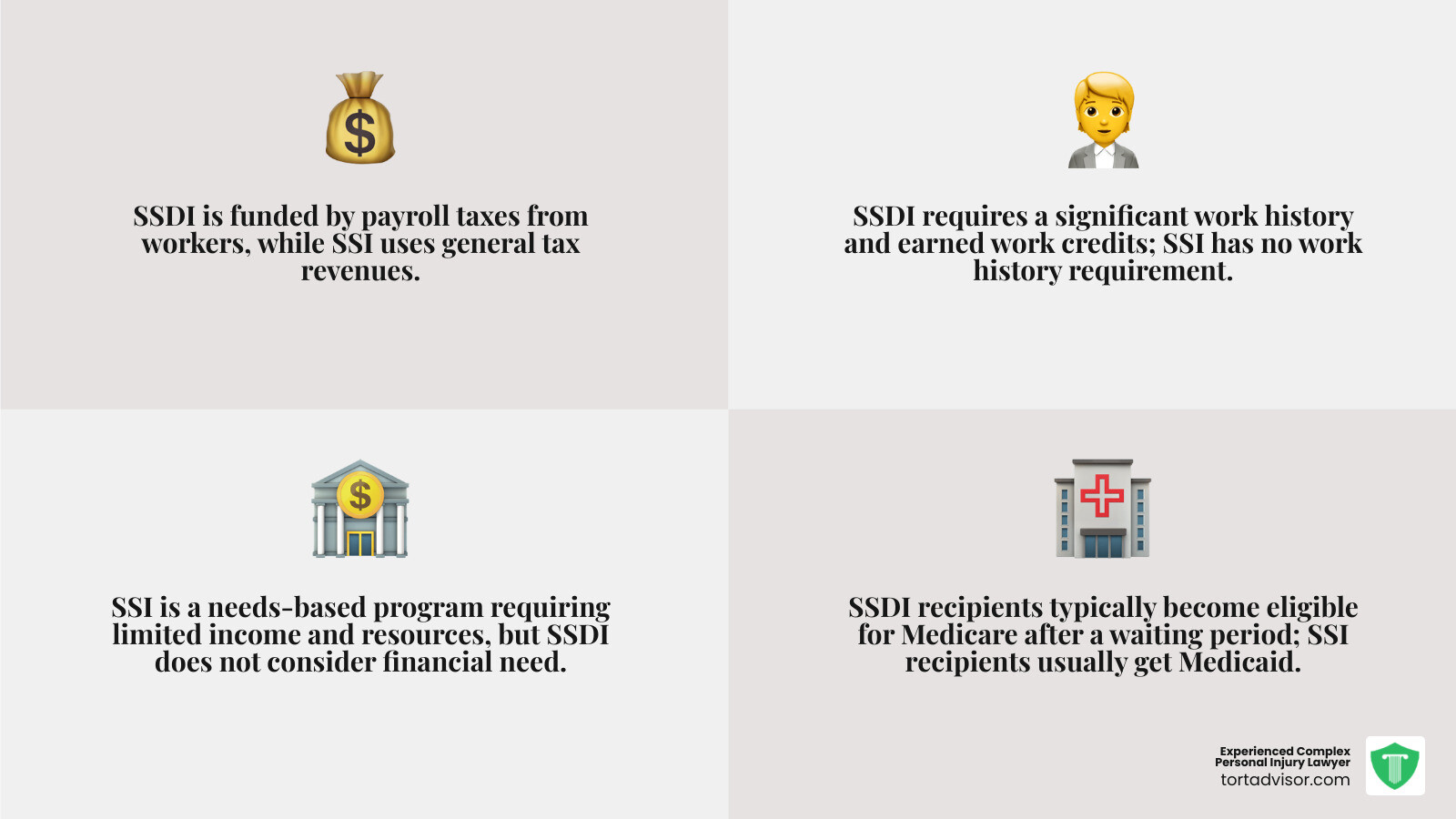

SSDI vs. SSI: Understanding the Key Differences

The main difference is how you qualify. SSDI is an earned benefit based on your work history and Social Security tax contributions. Your income and assets do not affect eligibility. SSI is a needs-based program for those with limited income and resources, regardless of work history. The table below highlights the key distinctions.

| Feature | Social Security Disability Insurance (SSDI) | Supplemental Security Income (SSI) |

|---|---|---|

| Funding Source | Funded by payroll taxes (FICA) paid by workers, employers, and self-employed individuals into Social Security trust funds. | Funded by general tax revenues, not Social Security taxes. |

| Work History | Requires a significant work history and sufficient work credits earned by paying Social Security taxes. | Does not require a work history or work credits. |

| Financial Need | Is not a needs-based program; your income and assets (other than earnings) do not affect eligibility or benefit amount. | Is a needs-based program; eligibility is determined by strict limits on income and resources (assets). |

| Benefit Calc. | Based on your average lifetime earnings covered by Social Security. | Based on a federal benefit rate, reduced by any countable income. State supplements may also apply. |

| Health Coverage | Eligible for Medicare after a 24-month waiting period from the date of entitlement to benefits. | Typically eligible for Medicaid immediately upon approval, which provides health care assistance. |

| Taxability | SSDI benefits can be taxable income depending on your other income. | SSI benefits are generally not taxable income. |

It is possible to receive both benefits concurrently if your SSDI payment is low and you meet SSI’s financial limits. You can learn more about and compare SSDI and SSI benefits on the SSA’s website.

Benefits for Family, Returning to Work, and Medicare

SSDI can also provide protection for your family and includes other important provisions.

- Family Benefits: Certain family members may receive monthly payments based on your work record, including a spouse (age 62+ or caring for your child under 16), a divorced spouse (under certain conditions), and unmarried children under 18 (or 19 if in school). Adult children disabled before age 22 may also qualify. You can learn about family benefits on the SSA website.

- Returning to Work: The SSA encourages returning to work with Work Incentives like the Ticket to Work program. These rules let you test your ability to work without immediately losing your benefits or health coverage. It’s wise to learn how returning to work could affect your eligibility.

- Medicare Coverage: You automatically become eligible for Medicare 24 months after your disability benefit entitlement date. This waiting period does not apply to those with ALS or End-Stage Renal Disease (ESRD).

- Retirement Conversion: When you reach full retirement age, your SSDI benefits automatically convert to retirement benefits. The amount generally stays the same.

Frequently Asked Questions about SSDI Qualifications

You’ve made it this far, and you’re probably still wondering about some of the practical details of SSDI benefits qualifications. These are the questions we hear most often, and they deserve straightforward, honest answers.

How long does the SSDI application process take?

Patience is key. The initial application process typically takes 6 to 8 months. Cases qualifying for expedited processing, like Compassionate Allowances, can be approved in weeks. However, if you need to appeal a denial, the timeline can extend significantly. A hearing before a judge can push the total time to a year or more.

Can I work while applying for SSDI?

Yes, but you must be extremely careful. Your monthly earnings must stay below the Substantial Gainful Activity (SGA) limit ($1,620 in 2025, or $2,700 if you’re blind). If you earn more than the SGA limit, the SSA will deny your claim at step one, regardless of your medical condition. You must report all work activity accurately.

How much will my SSDI benefit be?

Your benefit amount is personal and is not a flat rate. It’s calculated based on your average lifetime earnings on which you paid Social Security taxes. Higher lifetime earnings result in a higher benefit. The most accurate way to get an estimate is to create a “my Social Security” account and use the SSA’s online estimator, which uses your actual work history.

Get Help Navigating Your SSDI Claim

Let’s be honest: understanding SSDI benefits qualifications is complicated. With complex rules and a high denial rate for initial claims, it’s easy to feel overwhelmed. A denial doesn’t mean you don’t deserve benefits; it often means you need an experienced advocate.

SSDI claims are complex legal matters. The SSA has strict rules for evidence and documentation, and a simple oversight can derail a valid claim. This is where professional guidance is invaluable. An experienced disability attorney knows what the SSA looks for, how to build a strong case, and how to argue effectively at an appeal hearing.

At Tort Advisor, we connect people like you with top-rated attorneys who specialize in disability law. Our network includes only highly skilled lawyers with proven track records. Most work on contingency, meaning they only get paid if you win your case, with their fee taken from your back pay. There are no upfront costs.

Whether you’re starting your application or appealing a denial, the right attorney can handle the paperwork, gather evidence, and represent you. Don’t steer this challenging journey alone. Let us help you find expert legal help for your SSDI claim. Your disability has already disrupted your life; getting the financial support you’ve earned shouldn’t add to that burden.

Free Confidential Case Evaluation

Complete the short form below to get an immediate FREE case review with an expert in your specific claim. Don't wait, your case could be time sensitive to file a claim.

Related Posts

Discover New Jersey disability benefits: TDI, FLI, SSDI, SSI rates, eligibility, applications & appeals for 2025-2026.

Hire a Depo-Provera lawsuit attorney now. Fight Pfizer for meningioma risks from injections. Free consult, MDL updates & settlements up to $1.5M.

Find top Miami florida car accident lawyers after your 305 crash. Get max compensation, navigate no-fault laws & choose the best experts now!

Diagnosed with cancer after Roundup? Learn about the monsanto roundup lawsuits, eligibility criteria, and how to pursue your claim.

Discover how do you qualify for a hair relaxer lawsuit: criteria, diagnoses, evidence & brands in uterine cancer MDL. Claim review now!

Find the best uber sexual assault lawsuit lawyer: expert guides, MDL experience, proven results & nationwide firms for justice.