Why Understanding the SSDI and Medicare Connection Matters

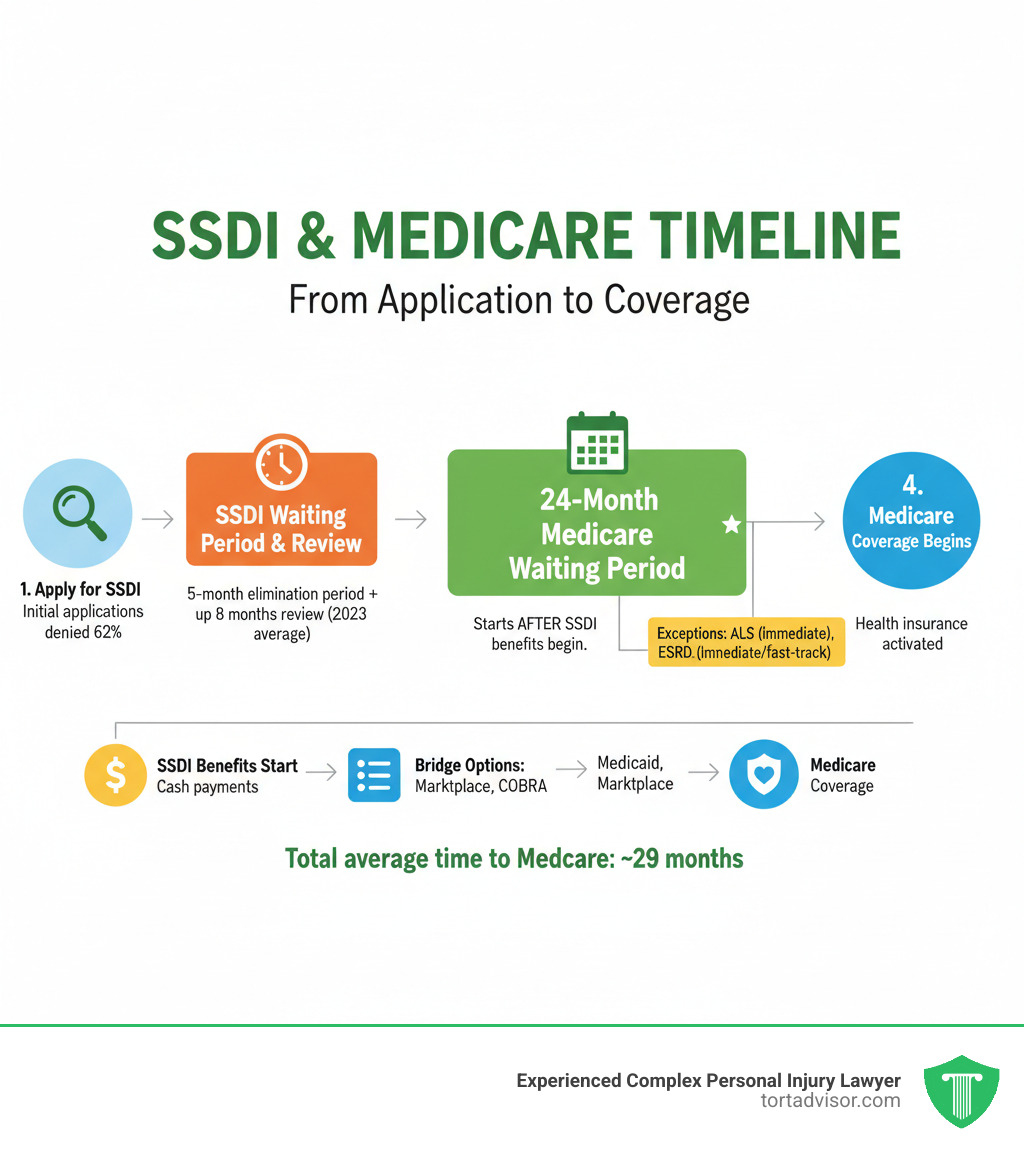

SSDI and Medicare are linked federal programs providing critical support to people with disabilities. Here’s a quick overview:

- SSDI (Social Security Disability Insurance): Provides monthly cash benefits to those who can’t work due to a severe disability and have a sufficient work history.

- Medicare: Federal health insurance that SSDI recipients automatically qualify for after a 24-month waiting period.

- The 24-month wait: Starts from your SSDI benefit entitlement date, not when you apply or become disabled.

- Exceptions: ALS (Lou Gehrig’s disease) and End-Stage Renal Disease (ESRD) grant immediate Medicare coverage.

- Bridging the gap: Options like Medicaid, Marketplace plans, or COBRA can provide coverage during the waiting period.

Understanding this connection is vital. Your disability benefits open the door to health coverage, but the timeline can be confusing. For most, the total wait from disability onset to Medicare is 29 months (a 5-month SSDI wait plus the 24-month Medicare wait).

The biggest hurdle is getting approved for SSDI. Initial applications are denied 62% of the time, and average review times have grown to nearly 8 months. Many people face years of appeals before securing benefits and the health coverage that comes with them. Having clear, accurate information is critical when your health and financial security are on the line.

Simple guide to SSDI and Medicare terms:

Understanding SSDI and How It Opens Up Medicare

If you can’t work due to a disability, Social Security Disability Insurance (SSDI) is often the first step toward securing both income and health insurance. SSDI and Medicare work together, but understanding the connection is key.

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal insurance program run by the Social Security Administration (SSA). It provides monthly income to people who can no longer work due to a serious medical condition. It’s an earned benefit, funded by the Social Security (FICA) taxes you’ve paid throughout your career.

To qualify, you generally need about ten years of work history to have earned enough work credits. However, the SSA also uses a strict definition of disability. Your condition must be severe enough to prevent you from performing “substantial gainful activity” (earning over a certain monthly amount) and be expected to last at least 12 months or result in death.

How SSDI Eligibility Leads to Medicare

SSDI approval automatically creates a pathway to Medicare, even if you are under age 65. After you receive SSDI benefits for 24 months, your Medicare coverage begins automatically. This means SSDI approval provides not just monthly income, but also access to comprehensive health insurance.

In 2021, 8.1 million people under 65 had Medicare specifically because they qualified through SSDI. This link is a critical safety net. You can learn more about The Connection Between Social Security Disability Benefits and Health Coverage to understand how these programs protect you.

The Challenge of Getting Approved for SSDI

Getting approved for SSDI is difficult. The application is complex, wait times are long, and denial rates are high. A staggering 62% of initial applications are denied. Proving your case requires meticulous medical evidence and often multiple attempts.

The average wait for an initial decision has grown to nearly 8 months. If you’re denied, the appeals process can take years. This is where experienced legal help is crucial. If you’ve received a Denied Disability Claim, don’t give up. An attorney can help you steer the Disability Appeal Process by gathering the right evidence for the SSA. Legal representation can significantly increase your chances of success and reduce approval time, making it an essential step when your income and health insurance are at stake.

The 24-Month Medicare Waiting Period: Your Coverage Options

After SSDI approval, most people face a 24-month waiting period before SSDI and Medicare coverage begins. This section explains the wait and how to stay insured during this gap.

What is the 24-Month Waiting Period?

The 24-month wait starts from your SSDI “entitlement date,” which is typically five months after the SSA determines your disability began. This creates a total 29-month gap from disability onset to Medicare coverage (5-month SSDI wait + 24-month Medicare wait).

After 24 months of receiving SSDI benefits, you are automatically enrolled in Medicare Part A and Part B. About three months before your coverage starts, you will receive your Medicare card in the mail.

Exceptions That Waive the Waiting Period

Two severe conditions grant faster Medicare access:

- Amyotrophic Lateral Sclerosis (ALS): If you have ALS (Lou Gehrig’s disease), Medicare coverage begins the same month your SSDI benefits start, with no waiting period.

- End-Stage Renal Disease (ESRD): If you have permanent kidney failure requiring dialysis or a transplant, Medicare can begin as early as the fourth month of dialysis.

Health Insurance Options While You Wait

Staying insured during the waiting period is critical. Here are your main options:

- Medicaid: This state and federal program covers people with low income and resources. If you receive SSI, you likely qualify automatically. Even with only SSDI, you should apply through your state’s Medicaid agency or Healthcare.gov.

- Marketplace (ACA) plans: If your income is too high for Medicaid, plans from Healthcare.gov may offer premium tax credits. These subsidies end once your Medicare coverage starts.

- COBRA: You can continue your former employer’s health plan for up to 18 months by paying the full premium. While expensive, it provides continuity of care.

- Private Insurance: Plans purchased directly from insurance companies are also an option, though typically the most expensive without subsidies.

Your Comprehensive Guide to SSDI and Medicare Coverage

Once your Medicare coverage begins, you need to understand its different parts and choose the right plan.

The Different Parts of Medicare Explained

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, and hospice. For most SSDI recipients, Part A is premium-free.

- Part B (Medical Insurance): Covers doctor visits, outpatient care, and preventive services. Part B has a monthly premium, which is usually deducted from your Social Security benefit.

- Part C (Medicare Advantage): These are private plans that bundle Parts A and B, and often Part D. Many offer extra benefits like dental, vision, and hearing coverage.

- Part D (Prescription Drug Coverage): This optional coverage helps pay for prescription medications. You can get it as a standalone plan or as part of a Medicare Advantage plan.

Choosing Your Path: Original Medicare vs. Medicare Advantage

You have two main choices for your SSDI and Medicare coverage:

Original Medicare (Parts A & B) is the government-run program. It offers the freedom to see any doctor or hospital that accepts Medicare nationwide without referrals. However, it has out-of-pocket costs (deductibles, coinsurance) and no annual spending cap. You’ll also need a separate Part D plan for prescriptions.

Medicare Advantage plans are offered by private companies. They usually include prescription drug coverage and extra benefits. The trade-off is that they typically have provider networks and may require referrals to see specialists.

The best choice depends on your health needs, budget, and preference for flexibility versus structured benefits.

Filling the Gaps: Medigap, SNPs, and Cost-Saving Programs

Several programs can help with Medicare costs:

- Medigap (Medicare Supplement) plans: These private plans work with Original Medicare to cover out-of-pocket costs like deductibles and coinsurance. Availability for those under 65 on SSDI varies by state.

- Medicare Special Needs Plans (SNPs): These are Medicare Advantage plans custom for people with specific chronic illnesses or those eligible for both Medicare and Medicaid.

- Medicare Savings Programs & Extra Help: If you have limited income, state-run Medicare Savings Programs can help pay for premiums and deductibles. The federal Extra Help program helps with Part D prescription drug costs. To see if you qualify, visit Medicare’s help paying for costs page.

Managing Work, Other Insurance, and Your Benefits

Life changes, and you may want to return to work or need to coordinate other insurance with your SSDI and Medicare benefits. Understanding the rules helps you maintain your financial and healthcare stability.

Returning to Work on SSDI

The SSA provides work incentives to help you transition back to the workforce without immediately losing benefits.

- Trial Work Period (TWP): You can test your ability to work for at least nine months while still receiving full SSDI benefits, regardless of how much you earn.

- Extended Medicare Coverage: Even if your earnings become too high and your SSDI cash benefits stop, you can keep your Medicare coverage for at least 8.5 years after returning to work.

- Ticket to Work Program: This free, voluntary program offers training and vocational rehabilitation to help you find and keep a job.

Always report your earnings to the SSA. For more details, see the SSA’s guide on working while disabled.

How Other Insurance Works with Your SSDI and Medicare

If you have other health insurance, “coordination of benefits” rules determine who pays first.

- Employer Insurance: If you have coverage from a large employer (100+ employees), that plan pays first, and Medicare is secondary. For small employers (fewer than 100), Medicare usually pays first.

- COBRA: Medicare is generally the primary payer if you have both Medicare and COBRA. An exception exists for those with End-Stage Renal Disease, where COBRA is primary for the first 30 months.

- VA Benefits: You can’t use both Medicare and VA benefits for the same service. You choose which one to use for each instance of care.

SSDI vs. SSI: Understanding the Key Differences for Health Coverage

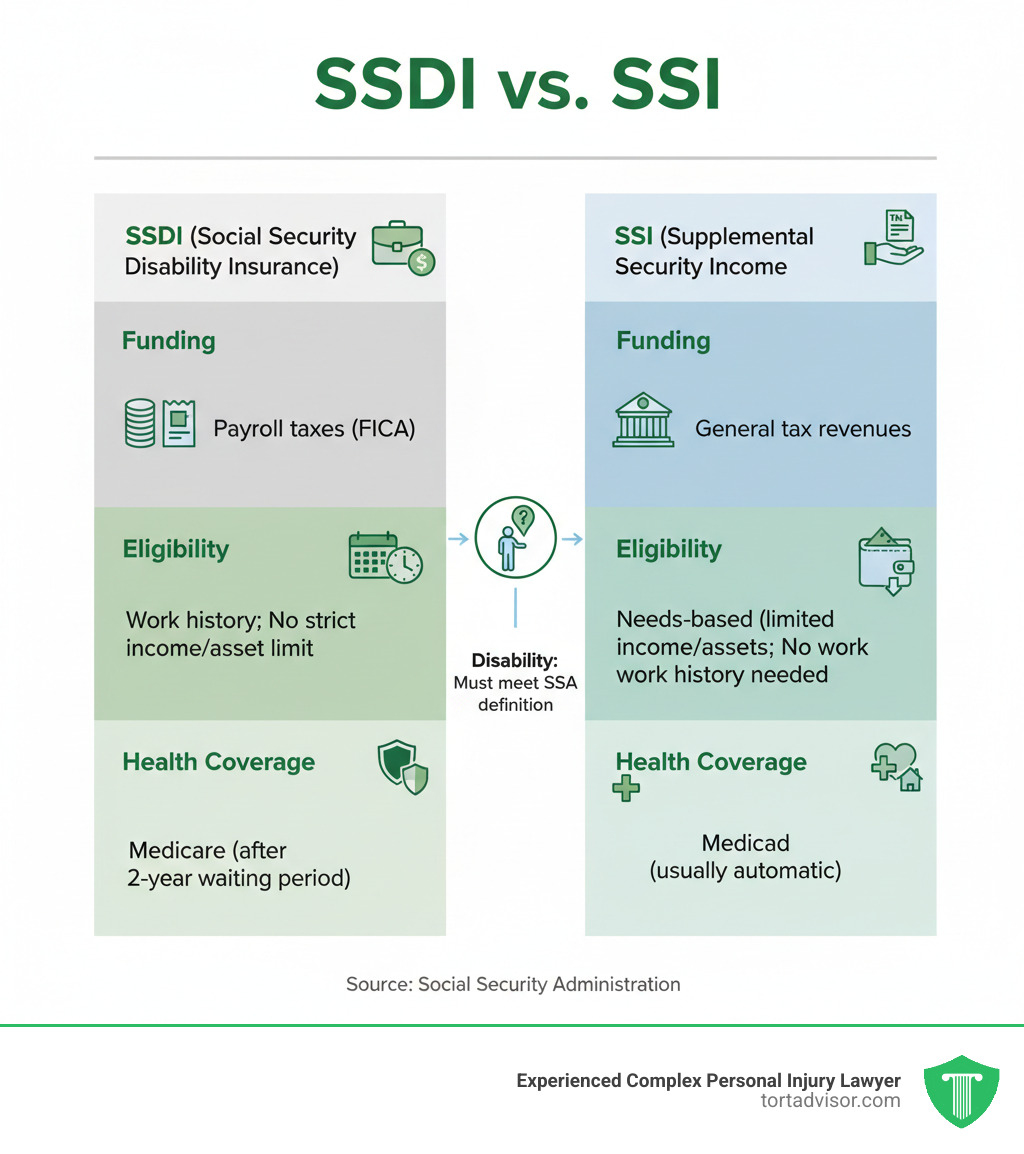

SSDI and SSI are different programs with different health coverage rules.

| Feature | SSDI (Social Security Disability Insurance) | SSI (Supplemental Security Income) |

|---|---|---|

| Funding | Payroll taxes (FICA) | General tax revenues |

| Eligibility | Based on work history and payment of Social Security taxes; not means-tested | Needs-based (limited income and resources); no work history required |

| Disability | Must meet SSA’s strict definition of disability | Must meet SSA’s strict definition of disability, or be 65+, or blind |

| Health Coverage | Medicare (after 24-month waiting period) | Medicaid (typically immediate eligibility) |

| Benefit Amt. | Based on average lifetime earnings (e.g., ~$1,500/month average in 2022) | Federally set rate, adjusted by income (e.g., ~$650/month average in 2022) |

| Dual Eligibility | Possible to receive both if SSDI benefit is low enough to qualify for SSI | Possible to receive both if SSDI benefit is low enough to qualify for SSI |

In short, SSDI is work-based and leads to Medicare after a 24-month wait. SSI is needs-based and leads to Medicaid, which is typically immediate. Some people with low SSDI benefits may qualify for both (“dual eligibility”), giving them both Medicare and Medicaid. To estimate your potential benefit, use our SSDI Benefit Calculator.

Frequently Asked Questions about SSDI and Medicare

Here are answers to common questions about navigating SSDI and Medicare.

Can I keep my Marketplace (ACA) plan after I get Medicare?

Yes, but it’s usually not a good idea. Once your Medicare coverage starts, you will lose any premium tax credits for your Marketplace plan. This means you’ll pay the full, unsubsidized price. A better financial choice is often to drop the Marketplace plan and consider Medigap supplement options to pair with Original Medicare. However, a Marketplace plan can be a crucial source of coverage during the 24-month Medicare waiting period.

Can I refuse Medicare Part B coverage?

You can refuse Part B, but be cautious. If you decline it and don’t have other “creditable coverage” (like from a current employer), you may face a permanent late enrollment penalty if you decide to sign up later. This penalty increases your Part B premium by 10% for each year you were eligible but not enrolled. Unless you have other solid coverage, it’s generally wise to enroll in Part B when you first become eligible.

How long can I keep Medicare if I go back to work?

Thanks to work incentives, you can keep your premium-free Medicare Part A coverage for at least 8.5 years after you return to work, even if your SSDI cash benefits stop due to your earnings. This extended coverage period includes your nine-month Trial Work Period plus an additional 7 years and 9 months. This safety net allows you to test your ability to work without the immediate fear of losing your health insurance.

Conclusion: Get the Help You Need to Secure Your Benefits

Navigating the connection between SSDI and Medicare is a complex journey, from the initial application and 24-month waiting period to choosing the right coverage. Making informed decisions about supplemental plans, work incentives, and cost-saving programs is critical for your health and financial peace of mind.

If you need help understanding your Medicare options, your State Health Insurance Assistance Program (SHIP) offers free, personalized counseling. However, all of these healthcare choices depend on one thing: getting approved for SSDI benefits.

With a 62% initial denial rate and long wait times, securing SSDI is a significant challenge. If your claim was denied or you find the process overwhelming, experienced legal help is essential. An attorney can ensure your case is presented effectively, gather the necessary medical evidence, and steer the appeals process.

The attorneys in the Tort Advisor network specialize in disability law and know what it takes to build a strong case, helping you get approved faster. Your health and financial security are too important to leave to chance. To get connected with a specialist who can help you steer SSDI lawsuits, contact us today.

Free Confidential Case Evaluation

Complete the short form below to get an immediate FREE case review with an expert in your specific claim. Don't wait, your case could be time sensitive to file a claim.

Related Posts

Discover New Jersey disability benefits: TDI, FLI, SSDI, SSI rates, eligibility, applications & appeals for 2025-2026.

Hire a Depo-Provera lawsuit attorney now. Fight Pfizer for meningioma risks from injections. Free consult, MDL updates & settlements up to $1.5M.

Find top Miami florida car accident lawyers after your 305 crash. Get max compensation, navigate no-fault laws & choose the best experts now!

Diagnosed with cancer after Roundup? Learn about the monsanto roundup lawsuits, eligibility criteria, and how to pursue your claim.

Discover how do you qualify for a hair relaxer lawsuit: criteria, diagnoses, evidence & brands in uterine cancer MDL. Claim review now!

Find the best uber sexual assault lawsuit lawyer: expert guides, MDL experience, proven results & nationwide firms for justice.