Why Reporting Vehicle Accidents Properly Protects Your Rights

How to report a motor vehicle accident depends on your location, but the basic steps remain consistent: call 911 if anyone is injured, exchange information with other drivers, document the scene with photos, and file the required reports within your jurisdiction’s deadlines.

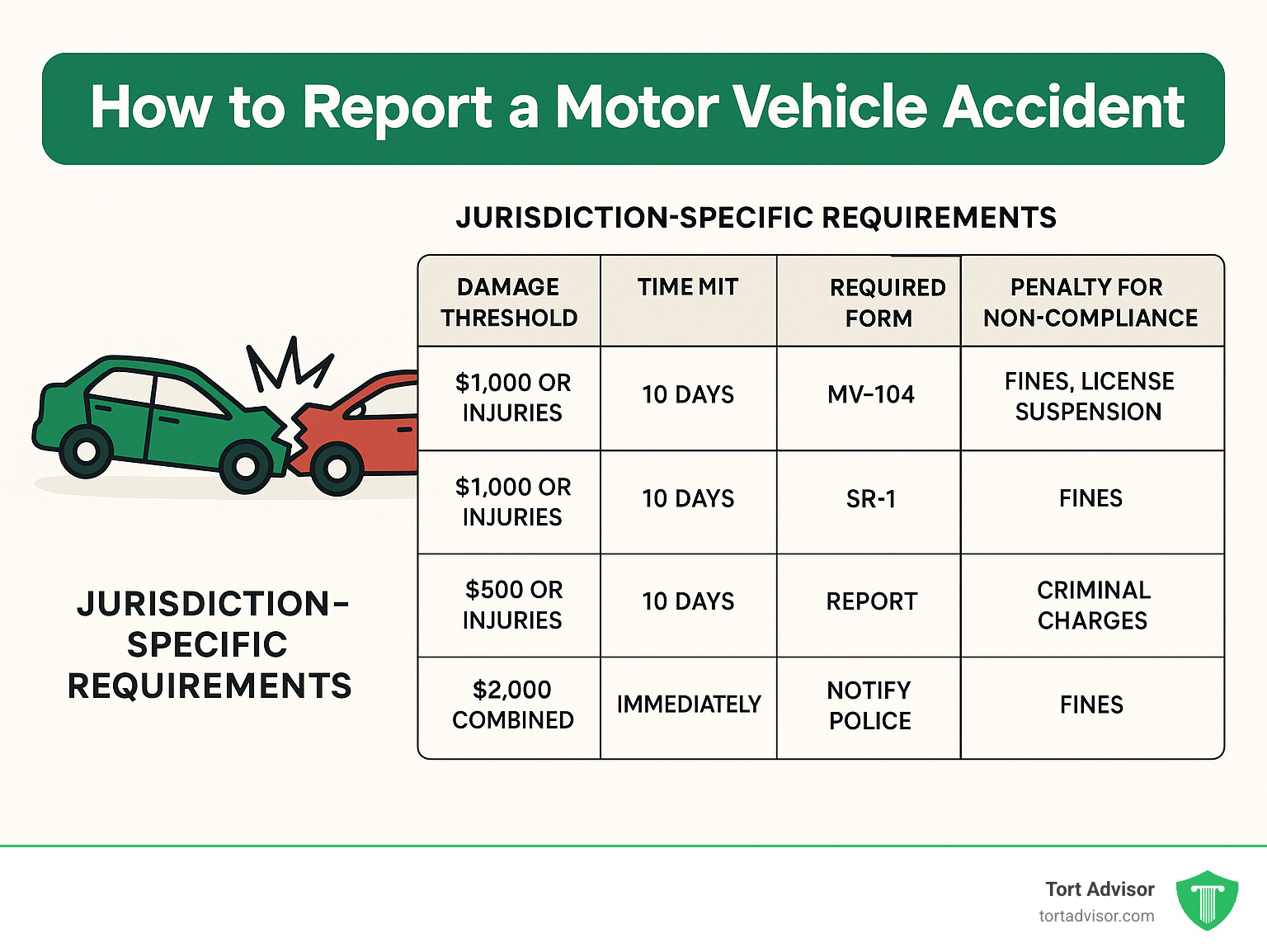

Quick Reference for Reporting Requirements:

- Call 911 immediately if there are injuries, fatalities, or vehicles blocking traffic

- Exchange information – driver’s license, insurance, vehicle registration details

- Document everything – photos of damage, scene, license plates, and witness contact info

- File official reports within required timeframes:

- New York: MV-104 form within 10 days for $1,000+ damage or injuries

- California: SR-1 report within 10 days for $1,000+ damage or injuries

- Florida: Report within 10 days for $500+ damage or injuries

- Canada (Ontario): Report to police if combined damage exceeds $2,000

Vehicle collisions affect over 300,000 New Yorkers annually, and failure to report properly can result in license suspension, fines up to $405, or even criminal charges. The confusion and stress following an accident often leads to missed deadlines or incomplete documentation – mistakes that can cost you thousands in denied insurance claims or legal penalties.

Whether you’re dealing with a minor fender-bender or a serious crash, understanding your reporting obligations helps you stay compliant with the law while protecting your insurance coverage and legal rights. Different jurisdictions have varying damage thresholds, time limits, and reporting methods – from online portals to specialized Collision Reporting Centres.

Why a Clear Plan Matters

Having a structured approach to accident reporting isn’t just about following the law – it’s about protecting yourself from financial and legal complications down the road. When you know exactly what to do, you can reduce panic in an already stressful situation, speed up insurance claims processing, and ensure full compliance with legal requirements.

Our research shows that drivers who follow proper reporting procedures receive insurance payouts 40% faster than those who submit incomplete or late documentation. More importantly, you’ll have peace of mind knowing you’ve done everything correctly to protect your rights and interests.

Who This Guide Helps

This comprehensive guide assists anyone involved in or witnessing a motor vehicle collision, including:

- Drivers of passenger vehicles, motorcycles, and commercial vehicles

- Passengers who may need to report on behalf of an injured driver

- Pedestrians and cyclists involved in vehicle collisions

- Witnesses who observed an accident and want to provide statements

- Fleet managers handling company vehicle incidents

No matter your role in an accident, understanding the reporting process helps ensure proper documentation and legal compliance.

When Are You Legally Required to Report a Crash?

Understanding when you’re legally required to report an accident can save you from serious consequences down the road. The requirements vary quite a bit depending on where you live, but there are some universal triggers that apply everywhere.

Every jurisdiction requires reporting when someone gets hurt or killed, no matter how minor the injury might seem. Beyond that, the rules start to differ based on property damage amounts, and these thresholds can catch drivers off guard.

Property damage limits are where things get interesting. New York, California, and Wisconsin all require reporting when combined damage hits $1,000 or more. Vermont sets their bar higher at $3,000, while Ontario requires reporting at $2,000. These amounts represent the total damage to all vehicles and property involved – so if your car has $700 in damage and the other vehicle has $400, that $1,100 total triggers reporting requirements in most states.

Hit-and-run incidents always require reporting, regardless of damage amounts. The same goes for crashes involving commercial vehicles, situations where drivers appear impaired, or accidents with uninsured motorists in certain states.

Penalties for not reporting can be surprisingly harsh. Alberta hits non-reporters with a $405 fine, while other jurisdictions threaten license suspension. Even Vermont’s seemingly modest $30 fine can escalate if you’re involved in future incidents.

Mandatory Time Limits by Jurisdiction

Time limits for reporting accidents are all over the map, and missing these deadlines can create serious problems. The key is understanding which situations need immediate attention versus those that give you more time to gather information.

Immediate reporting through 911 is required when anyone gets hurt, even if it’s just minor bruises. Florida is particularly strict about this – any injury, no matter how small, triggers an immediate reporting requirement. The same goes for fatalities, blocked roadways, or dangerous situations like hazardous material spills.

Short-term deadlines can sneak up on you. Vermont gives you 72 hours to file written crash reports for accidents involving $3,000 or more in damage. Alberta requires you to visit a Collision Reporting Centre within 24 hours for crashes with $5,000 or more in damage.

Extended deadlines provide more breathing room but still require attention. New York and California both give you 10 days to file DMV reports for qualifying accidents. Florida follows the same 10-day rule for crashes involving $500 or more in damage.

Missing these deadlines carries real consequences. Vermont’s $30 fine might seem manageable, but Alberta’s $405 penalty definitely isn’t. Some jurisdictions will suspend your license for non-compliance, which can affect your job, insurance rates, and daily life.

Collisions That Always Require Police

Some accident situations are so serious that police involvement isn’t optional – it’s mandatory regardless of damage amounts. These scenarios require immediate 911 calls and professional investigation.

Fatalities or serious injuries requiring ambulance transport always trigger police response. Officers need to investigate the scene, collect evidence, and create official documentation that insurance companies and courts will accept.

Impaired driving situations where alcohol or drugs are suspected require police intervention. Commercial vehicle crashes involving vehicles over certain weight limits often fall under federal regulations requiring police reports. Hit-and-run scenarios where a driver attempts to flee create criminal liability issues that require police investigation.

The bottom line is that when you’re unsure whether to call police, it’s better to err on the side of caution. Proper police documentation provides the strongest foundation for insurance claims and legal proceedings if they become necessary.

How to Report a Motor Vehicle Accident: Step-by-Step

Learning how to report a motor vehicle accident is easiest if you break it into three phases: stay safe, gather evidence, then file the report. The core actions never change, but the reporting channel and deadline vary by location.

1. Immediate Post-Crash Actions

- Turn on hazard lights and, if traffic allows, move vehicles to a shoulder or parking lot.

- Check everyone for injuries. When in doubt, call 911—better too early than too late.

- Secure the scene: place reflective triangles or flares (skip flares if you smell gasoline) and switch all engines off.

- Use the correct emergency number. On Florida highways, *347 (Star FHP) often connects faster than regular 911.

2. Collect & Preserve Evidence

- Exchange information: full names, phone numbers, driver’s-license details, insurance company & policy numbers, VINs, and plates. Photograph documents to avoid transcription errors.

- Take systematic photos—wide shots of the scene, close-ups of every vehicle’s damage, licence plates, skid marks, traffic lights, weather conditions, and any road hazards. Research shows thorough photo evidence improves claim outcomes .

- Speak to witnesses before they leave. Record their contact info plus a one-sentence description of what they saw.

3. Choose Your Reporting Channel

- Police on scene – their report often satisfies legal requirements, but many states still need a follow-up DMV form within 10 days.

- Online portals – Colorado, Wisconsin, New York, and several Canadian provinces accept self-reports 24/7. Prepare files (PDF, JPG, PNG) under 25 MB and save work often to avoid session time-outs.

- Collision Reporting Centres (CRCs) – mandatory for non-emergency crashes in Ontario ($2,000+ damage) and Alberta ($5,000+). Book online when available, then drive the vehicle to the centre within 24 hours.

- Phone reporting – British Columbia’s ICBC handles claims at 604-520-8222 (Lower Mainland) or 1-800-910-4222.

4. Prepare Documents Before Submitting

Have these ready so you can complete the report in one sitting:

- Driver’s licence, registration, and insurance slip (clear photos work fine).

- Incident number supplied by police or dispatch, if any.

- Photos, witness info, medical paperwork, and repair estimates.

Treat reporting like filing taxes: accuracy and completeness today prevent expensive corrections later.

Jurisdictional Nuances & Special Reporting Centres

Collision Reporting Centres (CRCs)

CRCs streamline non-emergency accident handling in many Canadian cities:

- Toronto, ON – East & North CRCs, open 8 a.m.–midnight, required for crashes with $2,000+ combined damage.

- Edmonton, AB – Partnership between Edmonton Police Service and Accident Support Services International (ASSI). Report within 24 hours for $5,000+ damage or face a $405 fine.

- Special kiosks exist for cyclist or pedestrian collisions so police can focus on serious road emergencies.

Typical visit flow:

- Optional online pre-report to cut wait time.

- Staff photograph damage and apply a “Damage Reported to Police” sticker.

- You complete a diagram and narrative; staff forward everything to your insurer.

Online & Phone Self-Reporting in the U.S.

- Colorado DMV – Self-report online when no officer attended the scene (form kept for record only).

- Wisconsin “Start Now” – 30-minute session limit; gather licence, VIN, and insurance details beforehand.

- New York MV-104 – PDF upload or postal mail within 10 days for $1,000+ damage or any injury.

Technical tips: maximum 25 MB per file, use PDF/JPG/PNG, and enable JavaScript.

Consequences of Not Reporting & How to Get Your Report

Nobody wants to deal with paperwork after a stressful accident, but skipping the reporting requirements can turn a bad day into a legal nightmare. The consequences range from annoying fines to serious criminal charges, depending on your jurisdiction and the severity of the crash.

Criminal charges are the most serious consequence you’ll face. If someone was injured and you leave without reporting, you’re looking at hit-and-run charges – that’s a felony in most places. Even for property-damage-only crashes, New York treats failure to file the required MV-104 report as a misdemeanor offense that goes on your criminal record.

License suspension happens automatically in many states when you don’t report qualifying accidents. Your driving privileges get yanked until you comply with all reporting requirements, and getting them back often involves additional fees and bureaucratic headaches.

The civil penalties might seem lighter, but they add up quickly. Florida hits you with a $30 nonmoving violation for not reporting crashes over $500 in damage. Alberta is much tougher – they’ll fine you $405 if you don’t report accidents with $5,000+ damage within 24 hours. These fines often come with points on your license and higher insurance premiums.

Insurance companies can deny your claim entirely if you report late or incompletely. They use late reporting as evidence that the accident wasn’t serious or that you’re trying to hide something. Even if they don’t deny the claim outright, expect delays, reduced payouts, and premium increases at renewal time.

The practical consequences hurt just as much as the legal ones. Evidence disappears quickly after an accident – witness memories fade, skid marks get washed away, and security camera footage gets overwritten. The longer you wait, the harder it becomes to prove what really happened.

Obtaining a Copy Later

Getting copies of your accident report depends on who filed the original paperwork. The process varies, but knowing where to look saves time and frustration when you need documentation for insurance claims or legal proceedings.

Police-filed reports are the most common type you’ll need to retrieve. Contact the responding police department directly – this might be local city police, county sheriff, or state highway patrol depending on where the accident happened. Most agencies have records departments that handle these requests specifically.

The processing time can be frustrating – allow up to 90 days for complex reports to be completed and entered into the system. Officers need time to investigate, interview witnesses, and write detailed narratives.

Fees typically range from $10 to $25 per report copy, and most agencies only accept specific payment methods. Call ahead to ask about their preferred payment process – some want money orders, others take credit cards, and a few still require exact cash.

DMV-filed reports follow different procedures since you submitted them yourself. The Florida FLHSMV charges $10 for crash report copies, but they’re only available 60 days after you submit your self-report. New York offers online access through their “Get an accident report” tool, which is much faster than waiting for mail.

Colorado requires Form DR2489 with the appropriate fee mailed to their Driver Control Section. It’s old-school, but it works – just don’t expect quick turnaround times.

Insurance company reports are often the easiest to obtain since you’re already their customer. ICBC automatically notifies insurers through secure portals when you use Collision Reporting Centres, so your claim file should already have everything needed. For private insurers, contact your claims adjuster directly – they can usually email copies within hours.

The key is knowing how to report a motor vehicle accident properly from the start, so you don’t have to chase down paperwork later when deadlines are looming and insurance companies are asking questions.

Frequently Asked Questions about Reporting Accidents

When you’re dealing with the aftermath of a collision, questions start racing through your mind. Let me address the most common concerns people have about how to report a motor vehicle accident in different situations.

Do I need to report a minor parking-lot scrape?

That little bump in the grocery store parking lot might seem harmless, but don’t let the “minor” nature fool you. Even small scrapes can lead to bigger headaches if not handled properly.

The short answer: It depends on your location’s damage threshold and whether anyone got hurt. Most parking lot fender-benders don’t require police reports unless the combined damage hits your state’s reporting limit – usually between $500 and $1,000.

Here’s what you should always do, regardless of reporting requirements:

Exchange information with the other driver, including names, phone numbers, insurance details, and driver’s license numbers. Take photos of both vehicles, the surrounding area, and any visible damage. Even that tiny scratch might cost more to fix than you think.

Report to your insurance company within 24-48 hours, even if you don’t plan to file a claim. Your insurer needs to know about any incident involving your vehicle, and waiting too long can complicate things if the other driver later claims additional damage or injuries.

What if the other driver is uninsured or flees?

These scenarios are unfortunately common and require immediate action to protect your interests.

When dealing with uninsured drivers, your first step is calling the police. Some states like Alabama automatically require police reports for any accident involving an uninsured motorist. Even if it’s not legally required in your area, having an official police report becomes crucial for your insurance claim.

Document everything carefully when the other driver lacks insurance. Take extra photos, collect witness statements, and note every detail about the other vehicle and driver. Your insurance company will need this information to process your uninsured motorist coverage.

Hit-and-run situations demand immediate action. Call 911 right away – don’t waste time chasing the fleeing vehicle or putting yourself in danger. Note the license plate number, vehicle make and model, color, and direction of travel if you can do so safely.

Look for evidence the fleeing driver might have left behind. Paint transfer on your vehicle, broken headlight pieces, or other debris can help police identify the other car. Check for nearby security cameras at businesses or traffic intersections that might have captured the incident.

How do pedestrians or cyclists file a report?

If you’re a pedestrian or cyclist involved in an accident with a vehicle, your reporting process follows similar steps but with some important differences.

Always call 911 if you’re injured, no matter how minor it seems. Pedestrian and cyclist injuries can be deceptive – adrenaline masks pain, and some injuries don’t show symptoms immediately. Even if you feel fine at the scene, it’s worth getting checked out.

Document your property damage just like vehicle damage. That damaged bicycle, torn clothing, or broken phone counts toward the damage threshold for reporting requirements. In many jurisdictions, bicycle damage gets calculated the same way as vehicle damage when determining if you need to file official reports.

Take photos of everything – the vehicle that hit you, your injuries (if visible), damaged equipment, and the accident scene. Note whether you were wearing safety gear like helmets or reflective clothing, as this information often becomes important for insurance and legal proceedings.

Knowing how to report a motor vehicle accident properly protects everyone involved, whether you’re behind the wheel, on foot, or pedaling down the street. When in doubt, it’s always better to report and document thoroughly than to skip steps and regret it later.

Conclusion & Your Legal Options

Knowing how to report a motor vehicle accident correctly gives you a solid foundation, but it’s really just the beginning of protecting yourself after a crash. Think of proper reporting as your insurance policy against future headaches – it creates the paper trail you’ll need if things get complicated down the road.

The reality is that even what seems like a simple fender-bender can snowball into something much bigger. Maybe the other driver seemed fine at the scene but claims injuries later. Perhaps your insurance company questions whether you followed proper procedures. Or you might find that “minor” damage actually costs thousands to repair properly.

At Tort Advisor, we’ve seen how quickly straightforward accidents can become legal nightmares when reporting goes wrong. That’s why we connect people with experienced attorneys who understand both the reporting requirements and what comes next. Our network includes specialists in every state and major cities like Chicago, Miami, Fort Lauderdale, and Hollywood who know exactly how local reporting rules affect your legal options.

You should definitely consider getting legal help if you’re dealing with:

Serious injuries that require ongoing medical treatment – these cases often involve complex insurance negotiations and significant money. Disputes over who’s at fault or fights with insurance companies about coverage – lawyers know how to use proper reporting to strengthen your position. Hit-and-run accidents especially with uninsured drivers – these situations require special legal strategies. Commercial vehicle crashes or accidents involving multiple parties – the reporting requirements alone can be overwhelming.

Here’s something many people don’t realize: time is not on your side after an accident. While you typically have years to file a lawsuit, insurance companies often demand notification within 24 to 48 hours. Miss that window, and you could lose coverage entirely. Some states also have surprisingly short deadlines for certain types of claims.

The good news is that you don’t have to figure this out alone. Whether you’re still at the accident scene wondering what forms to file, or you’re weeks later realizing you might have missed something important, experienced legal counsel can guide you through the process. They know which reporting requirements actually matter for your specific situation and which ones are just bureaucratic busywork.

The bottom line is this: proper accident reporting protects your rights, but it doesn’t guarantee the best outcome. Having someone in your corner who understands both the reporting process and the bigger legal picture gives you the best chance of a full recovery – both physically and financially.

Don’t let confusion about reporting requirements or fear of legal complications keep you from getting the help you deserve. The accident reporting process becomes much more manageable when you know what to expect and have professional guidance when you need it.

For more information about legal help after crashes, visit our car accident resources to connect with qualified attorneys in your area. They can help you steer both the immediate reporting requirements and any legal proceedings that might follow. Sometimes the peace of mind alone is worth the consultation.

Free Confidential Case Evaluation

Complete the short form below to get an immediate FREE case review with an expert in your specific claim. Don't wait, your case could be time sensitive to file a claim.

Related Posts

Discover New Jersey disability benefits: TDI, FLI, SSDI, SSI rates, eligibility, applications & appeals for 2025-2026.

Hire a Depo-Provera lawsuit attorney now. Fight Pfizer for meningioma risks from injections. Free consult, MDL updates & settlements up to $1.5M.

Find top Miami florida car accident lawyers after your 305 crash. Get max compensation, navigate no-fault laws & choose the best experts now!

Diagnosed with cancer after Roundup? Learn about the monsanto roundup lawsuits, eligibility criteria, and how to pursue your claim.

Discover how do you qualify for a hair relaxer lawsuit: criteria, diagnoses, evidence & brands in uterine cancer MDL. Claim review now!

Find the best uber sexual assault lawsuit lawyer: expert guides, MDL experience, proven results & nationwide firms for justice.