Why Understanding Disability Benefits Termination Matters for Your Financial Security

Disability benefits termination is when the Social Security Administration (SSA) or a private insurer decides you no longer qualify for payments. Understanding why this happens and what you can do about it is critical to protecting your income.

Top Reasons Your Benefits Might End:

- Medical Improvement: The SSA or insurer believes your condition has improved enough for you to work.

- Earning Too Much: Your income exceeds the Substantial Gainful Activity (SGA) limit.

- Non-Compliance: You fail to attend medical exams, provide documents, or follow prescribed treatment.

What Happens When Benefits Are Terminated:

- You receive a written notice explaining the reason and date.

- You have 10 days to request benefit continuation during an appeal.

- You can appeal through four levels: Reconsideration, ALJ Hearing, Appeals Council, and Federal Court.

Losing disability benefits can be devastating, especially if you’re also dealing with job loss. You face two separate legal systems—employment law and disability insurance law—each with its own strict deadlines. Missing a deadline for either can cost you thousands in support.

I’m Mason Arnao. I work with legal professionals to help people steer complex disability benefits termination cases. Through my work connecting clients with experienced attorneys, I’ve seen how critical it is to act quickly when your benefits are at risk.

Disability benefits termination terms to learn:

- Denied disability claim

- Disability claim assistance

Common Reasons for Disability Benefits Termination

When your disability benefits stop, it’s not arbitrary. The Social Security Administration (SSA) and private insurers follow specific rules. Understanding these reasons can help you protect your benefits or prepare a strong appeal.

Your Medical Condition Improves

The most common reason for disability benefits termination is the SSA determining your medical condition has improved enough for you to work. The SSA conducts Continuing Disability Reviews (CDRs) to check if you still meet their disability criteria. The frequency of these reviews depends on your prognosis:

- Medical Improvement Expected (MIE): Review every 6 to 18 months.

- Medical Improvement Possible (MIP): Review about every three years.

- Medical Improvement Not Expected (MINE): Review every seven years or so.

During a CDR, the SSA requests updated medical evidence. Your doctor’s documentation is critical to show how your condition continues to limit your ability to work. If the SSA concludes you’ve improved, they issue a cessation determination, and benefits typically end two months later.

You Return to Work or Earn Too Much

The SSA encourages beneficiaries to try working again. The key concept is Substantial Gainful Activity (SGA), which measures if your earnings are high enough to disqualify you. In 2022, the SGA limit was $1,350 per month for non-blind individuals. Consistently earning above this amount can lead to termination.

However, the SSA offers programs to ease the transition:

- Trial Work Period (TWP): A nine-month period (not necessarily consecutive) where you can earn any amount and still receive full benefits.

- Extended Period of Eligibility (EPE): A 36-month period after the TWP. You receive benefits for any month your earnings fall below the SGA limit.

It is critical to report all earnings to the SSA to avoid overpayments and penalties. If you’re considering returning to work, use our SSDI Benefit Calculator to understand how earnings might affect your payments.

Other Factors That Can End Your Benefits

Several other situations can trigger disability benefits termination:

- Not following prescribed treatment: If you refuse prescribed therapy or medication without good reason, the SSA may decide you could work if you followed treatment and terminate your benefits.

- Ignoring SSA requests: The SSA needs your cooperation. If you don’t respond to requests for records or they can’t locate you, they can suspend and terminate benefits. The SSA rules on benefit suspension outline this process.

- Incarceration: Your benefits are automatically suspended if you are incarcerated for more than 30 consecutive days.

- Social media activity: Insurers increasingly monitor claimants’ online profiles. Photos of you hiking or doing yard work can be used as evidence that you are more capable than claimed. Be mindful of what you post online.

- Reaching retirement age: Your disability benefits will naturally convert to retirement benefits. Your payment amount usually stays the same.

- Fraud: Intentionally misrepresenting your condition will result in immediate termination and potential criminal charges.

Navigating the Intersection of Job Loss and Disability

Losing your job while on disability is uniquely challenging. You’re juggling two separate legal systems—employment law and disability insurance—each with its own rules and deadlines. Missing a deadline for an employment claim could cost you severance, while missing a disability appeal deadline could end your monthly benefits.

Understanding how these systems interact is crucial to protecting your financial security.

Can an Employer Fire You While on Disability?

Generally, an employer cannot fire you because you have a disability. The Americans with Disabilities Act (ADA) requires employers to provide reasonable accommodations (like modified schedules or equipment) unless it causes an undue hardship on the business.

However, your employment can be legally terminated in some situations:

- Termination without cause: Your employer can let you go for business reasons, like downsizing, as long as it’s not discriminatory and they provide proper notice or severance.

- Termination for cause: Being on disability doesn’t protect you from dismissal for misconduct, such as theft or other serious policy violations.

- Frustration of contract: In rare cases, if your disability is so severe that there’s no realistic chance of you returning to work, a contract may be considered “frustrated.” Employers must first prove they’ve exhausted all accommodation options.

If you’re facing termination while on disability, it’s important to understand your specific rights.

Employer Obligations for Benefits After Termination

Your termination entitlements (from your employer) and your disability benefits (from an insurer) are two different things. Termination entitlements include severance and notice pay. Disability benefits come from a short-term or long-term disability insurance plan.

Crucially, employers must typically continue your disability benefit coverage throughout your statutory notice period. If they fail to do so, the employer can become “self-insured” and be held directly liable for the disability benefits you would have received. For example, in one case, a court awarded a terminated employee approximately $260,000 in damages for discontinued disability benefits that should have continued until age 65. Pay close attention to when your benefits coverage ends and seek legal advice if something seems wrong.

‘Own Occupation’ vs. ‘Any Occupation’ in LTD Policies

Most long-term disability (LTD) policies contain a change of definition clause that can dramatically affect your benefits, usually after two years.

- ‘Own Occupation’ (First 24 months): You qualify for benefits if your disability prevents you from performing the duties of your specific job. This is an easier standard to meet.

- ‘Any Occupation’ (After 24 months): The definition shifts. You now only qualify if you cannot perform any job for which you are reasonably suited by education, training, or experience. This is a much higher bar to clear.

This transition is a common trigger for disability benefits termination, as insurers look for reasons to argue you could work in a different capacity. If you’ve also lost your job, the insurer may argue that since you’re no longer in your “own occupation,” you should be able to find other work. Understanding which definition applies to you is key to protecting your benefits.

The Termination and Appeal Process: A Step-by-Step Guide

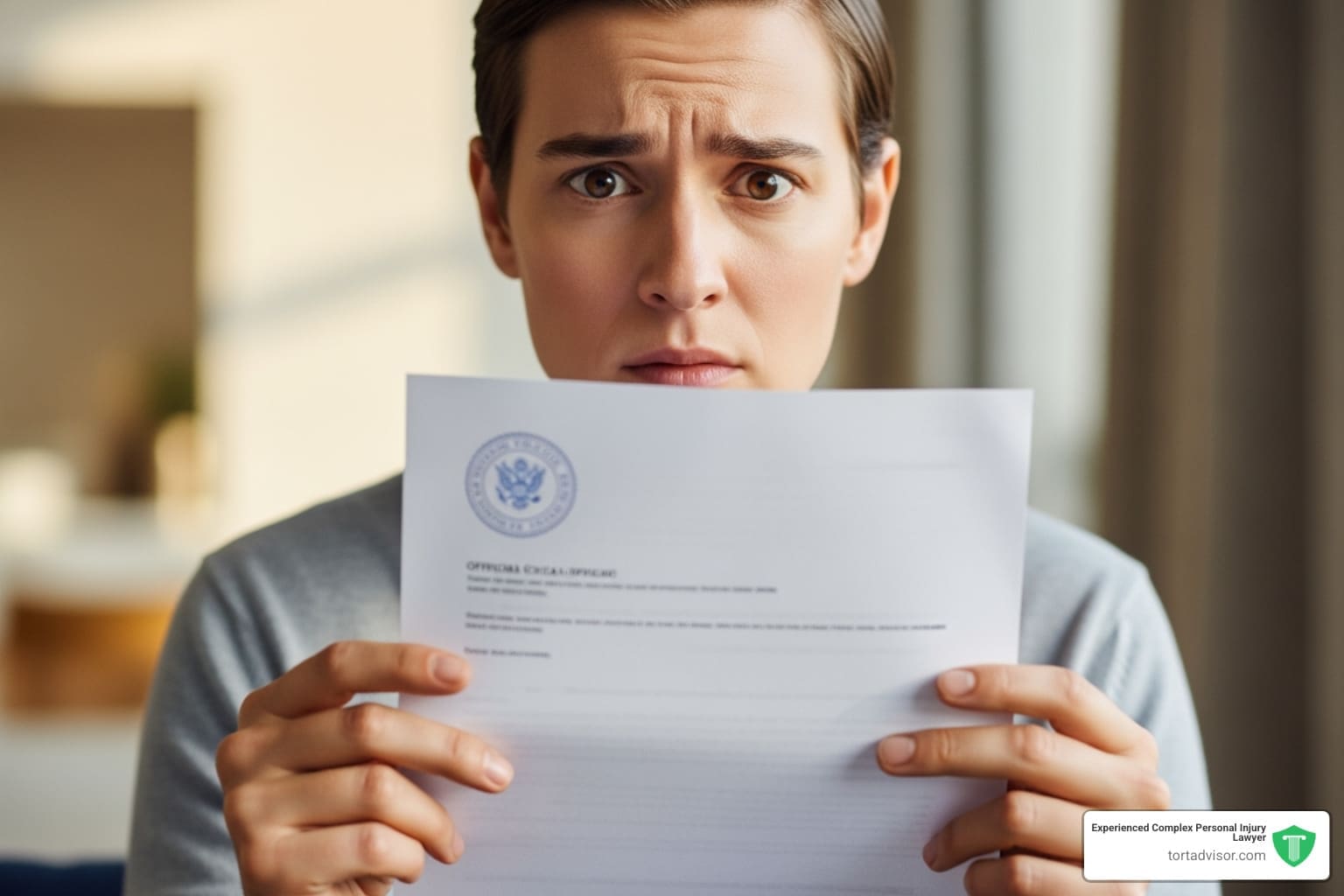

A notice of disability benefits termination is not the end of the story. It’s the start of a process where you have rights and options to fight the decision.

Understanding the Process for Disability Benefits Termination

You will receive a cessation notice explaining why your benefits are being cut, the effective date, and your appeal rights, as required by the SSA’s official cessation policy. This letter is your roadmap.

Pay close attention to the deadlines. You typically have just 10 days to request that your benefits continue during your appeal. Missing this window means your income stops immediately.

As soon as you get the letter, read it carefully, contact your doctor for fresh medical evidence supporting your inability to work, and gather all recent medical records. Building a strong case from the start is essential.

How to Appeal a Denied or Terminated Disability Claim

The SSA appeal process has four levels, each with strict deadlines:

- Reconsideration: A new person reviews your case and any new evidence you submit. This typically takes a few months.

- Hearing by an Administrative Law Judge (ALJ): This is often your best chance to win. You present your case in person to a judge. However, wait times for a hearing can be a year or longer.

- Appeals Council Review: If the ALJ denies your claim, you can ask the Appeals Council to review the decision. They may uphold it, send it back for another hearing, or approve it themselves.

- Federal Court Action: Your final option is to file a lawsuit in federal district court. This is a serious legal step where professional representation is vital.

Missing a deadline at any level can permanently end your appeal rights. We can provide Help with a Denied Disability Claim and connect you with attorneys who specialize in these cases.

Legal Recourse for Unfair Disability Benefits Termination

If your benefits were terminated unfairly, you may have legal options beyond the standard appeal. If a private insurer wrongfully terminated your long-term disability benefits, you can file a claim against them for breach of contract or acting in bad faith.

Potential outcomes include:

- Back-payment of benefits: Recovering all payments you were wrongfully denied.

- Reinstatement of benefits: Resuming your monthly payments.

- Damages for mental distress: Compensation for the emotional turmoil caused by the termination.

- Punitive damages: In cases of outrageous conduct, courts may award these to punish the insurer.

You might also have a wrongful dismissal claim against a former employer if they terminated you illegally while on disability. Protecting your rights in these complex situations often requires experienced legal help to steer the intersection of employment, insurance, and Social Security law.

Frequently Asked Questions about Disability Benefit Termination

Facing a potential loss of benefits brings up many questions. Here are answers to the most common concerns.

What is the first thing I should do if my disability benefits are terminated?

First, stay calm and focused. Panicking can lead to mistakes. Take these three steps immediately:

- Read the termination letter carefully. Understand the exact reason your benefits are being stopped, as this will shape your appeal strategy.

- Note all deadlines. The most critical is often the 10-day window to request benefit continuation. Write these dates down and set reminders.

- Contact a legal professional. An experienced disability attorney can review your case, help you gather evidence, and ensure you meet every deadline. Get Disability Claim Assistance to protect your rights.

Can my benefits be stopped without any warning?

Generally, no. The Social Security Administration (SSA) and private insurers must send you a written notice explaining the termination and your appeal rights. This is a legal requirement to protect you.

In rare cases, such as confirmed fraud, benefits might stop more abruptly. If your payments stop without any prior written explanation, it’s a major red flag. Contact a legal professional immediately to determine what happened and how to respond.

How long does the appeal process for a terminated claim usually take?

The timeline varies significantly by appeal level and location. The system is not fast, so it’s important to be prepared for a wait.

- Reconsideration (the first level) typically takes three to six months.

- An ALJ hearing (the second level) can have a wait time of a year or longer in many areas.

- Further appeals to the Appeals Council or Federal Court add more months or even years to the process.

This lengthy timeline makes it absolutely critical to act quickly and meet all initial deadlines. Every day counts when you’re facing a long wait for a final decision.

Conclusion

Understanding disability benefits termination is critical to your financial security. As we’ve covered, benefits can end for many reasons, from medical improvement to earning too much money. The situation becomes even more complex when it involves job loss, creating two separate legal challenges with their own strict deadlines.

A termination notice is not the final word. You have the right to appeal. The process—from Reconsideration to a hearing before an Administrative Law Judge—is your opportunity to challenge the decision with strong medical evidence and legal guidance.

Navigating employment law and disability insurance law is complicated, and the stakes are high. This is why Tort Advisor exists. We connect people facing disability benefits termination with experienced attorneys who specialize in these exact situations. Our nationwide network includes top-rated lawyers with proven results in disability law.

You don’t have to face this alone. The most important thing you can do is act quickly to protect your rights and meet critical deadlines. Get the professional legal help you need to fight for the benefits you deserve. Contact us for disability claim assistance today.

Free Confidential Case Evaluation

Complete the short form below to get an immediate FREE case review with an expert in your specific claim. Don't wait, your case could be time sensitive to file a claim.

Related Posts

Discover New Jersey disability benefits: TDI, FLI, SSDI, SSI rates, eligibility, applications & appeals for 2025-2026.

Hire a Depo-Provera lawsuit attorney now. Fight Pfizer for meningioma risks from injections. Free consult, MDL updates & settlements up to $1.5M.

Find top Miami florida car accident lawyers after your 305 crash. Get max compensation, navigate no-fault laws & choose the best experts now!

Diagnosed with cancer after Roundup? Learn about the monsanto roundup lawsuits, eligibility criteria, and how to pursue your claim.

Discover how do you qualify for a hair relaxer lawsuit: criteria, diagnoses, evidence & brands in uterine cancer MDL. Claim review now!

Find the best uber sexual assault lawsuit lawyer: expert guides, MDL experience, proven results & nationwide firms for justice.