Why Understanding Disability Benefits Matters When You Need Them Most

A Disability benefits guide is crucial because anyone can become disabled; a 20-year-old has a 1-in-4 chance of developing a disability before retirement age. When a medical condition prevents you from working, financial support from the Social Security Administration (SSA) is vital.

The SSA offers two main programs:

- Social Security Disability Insurance (SSDI): For workers who paid Social Security taxes.

- Supplemental Security Income (SSI): For low-income individuals, regardless of work history.

Key Facts:

- Your condition must prevent substantial work for at least 12 months or be terminal.

- SSDI requires sufficient work credits.

- SSI has strict income and asset limits.

- Average processing time is 6-8 months.

- You can appeal a denial (about 70% of initial claims are rejected).

- Family members may also be eligible for benefits.

Applying involves detailed medical evidence and navigating a complex system. This guide simplifies the process, explaining everything from eligibility and applications to appeals and managing your benefits.

As Mason Arnao, I specialize in making complex systems clear. This guide is your first step toward securing the support you deserve.

Simple Disability benefits guide glossary:

- Denied disability claim

- Disability claim assistance

- how to claim social security disability insurance arkansas

Understanding the Two Main Types of Disability Benefits

The Social Security Administration offers two federal programs for people with disabilities: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). Though both provide financial support, they have fundamental differences.

SSDI is an earned benefit. It’s like an insurance program funded by the Social Security taxes you paid while working. Your eligibility is based on your work history.

SSI is a needs-based program. It provides a safety net for people with disabilities who have very limited income and resources, regardless of their work history.

Understanding which program you qualify for is crucial, as the eligibility rules, benefit amounts, and health coverage differ significantly. Some people can even qualify for both. You can learn more about and compare SSDI and SSI benefits on the SSA’s website.

SSDI vs. SSI: A Head-to-Head Comparison

This table highlights the key differences:

| Criteria | Social Security Disability Insurance (SSDI) | Supplemental Security Income (SSI) |

|---|---|---|

| Funding Source | Social Security taxes paid by you and your employers. | General tax revenue from the U.S. Treasury. |

| Technical Eligibility | Requires a sufficient work history (“work credits”). | Based on financial need (limited income and assets). |

| Medical Eligibility | Must meet the SSA’s strict definition of disability. | Must meet the same medical definition as SSDI. |

| Health Coverage | Qualifies you for Medicare after a 24-month waiting period. | Usually makes you eligible for Medicaid immediately. |

| Benefit Amount | Based on your average lifetime earnings. | A standard federal rate, reduced by other income. |

In short, SSDI is tied to your work contributions, while SSI is tied to your financial need. Both programs use the same medical standards to define disability. The main differences lie in the non-medical requirements, how benefits are calculated, and which health insurance program (Medicare or Medicaid) you become eligible for.

Your Disability Benefits Guide to Eligibility Requirements

The Social Security Administration’s definition of disability is strict and focuses on your ability to work. A diagnosis alone is not enough. To qualify, your medical condition must be so severe that it prevents you from engaging in “substantial gainful activity” (SGA). In 2025, SGA is generally defined as earning more than $1,620 per month. Your condition must also be expected to last for at least 12 consecutive months or result in death.

The SSA uses a comprehensive list of qualifying conditions, known as the “Blue Book,” to evaluate impairments. Meeting a listing can streamline your approval, but you must provide thorough medical evidence, including records, test results, and doctor statements detailing your functional limitations.

Social Security Disability Insurance (SSDI) Eligibility

For SSDI, you must meet the medical requirements and be “insured” through your work history. This is measured in work credits, which you earn by paying Social Security taxes.

- The 20/40 Rule: Most applicants need 40 credits, with 20 earned in the 10 years before their disability began.

- Younger Workers: Fewer credits are required for younger applicants. For example, a person disabled at age 24 may only need 6 credits.

Your work must be recent to qualify. You can use the Social Security benefits questionnaire to verify your work credits.

Supplemental Security Income (SSI) Eligibility

SSI eligibility is based on financial need, not work history. The requirements are strict:

- Resources: An individual cannot have more than $2,000 in countable resources ($3,000 for a couple). Your home, one vehicle, and personal effects are typically not counted.

- Income: The maximum federal SSI payment is reduced by other income you receive, such as wages or other benefits.

- Residency: You must be a U.S. citizen or qualified non-citizen residing in the U.S.

Because not all assets and income are counted, it’s worth it to applying for SSI if you think you might be eligible.

Special Rules for Blindness and Low Vision

The SSA has more generous rules for applicants who are legally blind (vision no better than 20/200 in the better eye or a visual field of 20 degrees or less). The most significant difference is a higher SGA earnings limit. In 2025, blind individuals can earn up to $2,700 per month and still qualify for benefits. Work credit rules for SSDI are also more flexible. These provisions are detailed in the SSA’s publication on special rules for people who are blind or have low vision.

The Step-by-Step Process for Applying for Benefits

You can apply for disability benefits in the way that works best for you. The fastest method is often the online application. You can also apply by calling the SSA at 1-800-772-1213 (TTY 1-800-325-0778) or by scheduling an appointment at your local Social Security office.

Crucially, do not delay your application while trying to gather every document. The date you apply can affect when your benefits begin, so it’s best to start the process as soon as your disability prevents you from working. The SSA can help you obtain missing information later.

Information Needed for Your Application

To process your claim, the SSA needs detailed information about your medical condition and work history. Be prepared to provide:

- Personal Information: Your birth certificate and Social Security number.

- Medical Evidence: Names and contact information for all doctors, hospitals, and clinics that have treated you; a list of your medications; and dates of any lab tests or imaging.

- Work History: A detailed summary of the jobs you’ve held in the last 15 years, including your duties.

- Financials: A recent W-2 or tax return and your bank account information for direct deposit.

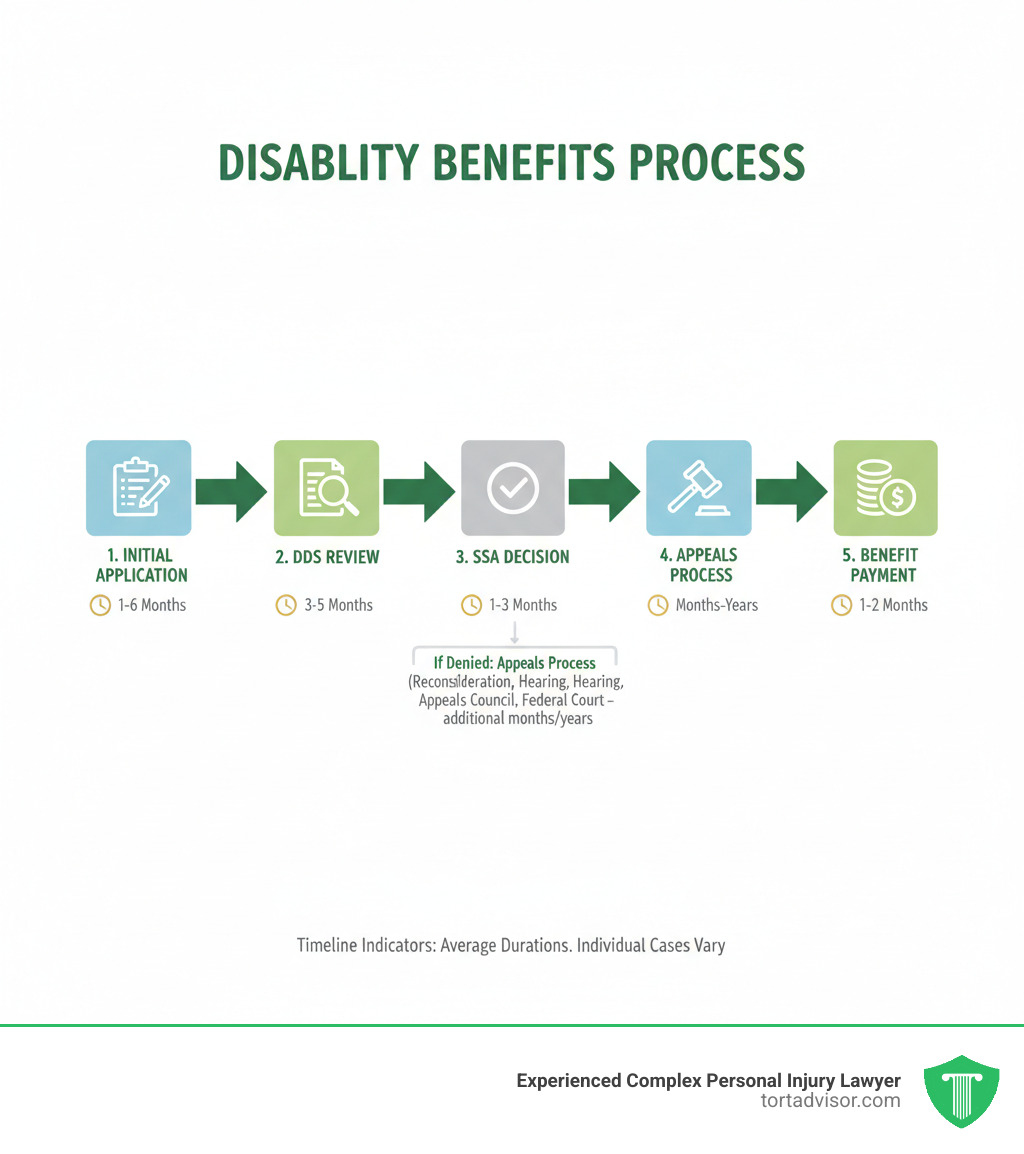

What to Expect: The Disability Claim Timeline

After you apply, your claim goes through a multi-stage review. First, the SSA checks for basic non-medical eligibility. Then, your file is sent to your state’s Disability Determination Services (DDS), where a team of specialists will conduct the medical review.

The DDS uses a 5-step evaluation process to decide if you meet the SSA’s definition of disability. They will gather your medical records and may ask you to attend a consultative exam. The initial decision typically takes 6 to 8 months.

If approved for SSDI, there is a 5-month waiting period before payments begin. This waiting period does not apply to SSI. The process is long and complex, which is why many applicants seek Disability Claim Assistance to help steer the system.

Managing Your Benefits: Payments, Work, and Denials

Approval for disability benefits brings financial relief, but it also comes with new responsibilities. Understanding how payments work, what to do if you’re denied, and the rules around working are key to managing your benefits effectively.

A Disability Benefits Guide to Payments and Calculations

Your benefit amount depends on which program you qualify for.

- SSDI: Your payment is calculated based on your average lifetime earnings. The average monthly payment was around $1,352 in late 2023, but your amount will be unique to your record.

- SSI: The payment is a standard federal rate ($914 for an individual in 2023), which may be supplemented by your state and is reduced by any other income you have.

You can get a personalized estimate using the SSA’s online benefits calculator or our SSDI Benefit Calculator. Payments are made monthly via direct deposit, on a schedule determined by your birth date. You can find out when you will receive your benefits from the SSA.

What Happens if Your Claim is Denied?

Nearly 70% of initial claims are denied, but a denial is not the end. You have the right to appeal. The four-level appeals process gives you multiple opportunities to prove your case:

- Reconsideration: A new examiner reviews your file.

- Hearing: You present your case in person to an Administrative Law Judge (ALJ). Many cases are won at this stage.

- Appeals Council: The council reviews the ALJ’s decision.

- Federal Court: The final step is to file a lawsuit in federal court.

The appeals process can be long, but persistence is key. If you’re facing a Denied Disability Claim, professional guidance is highly recommended. You can learn how you can appeal from the SSA.

A Disability Benefits Guide to Working and Reporting Changes

The SSA provides work incentives to help you return to work without immediately losing benefits. The Trial Work Period (TWP) allows SSDI recipients to test their ability to work for up to nine months while still receiving full benefits. The Ticket to Work program offers free employment support. For details, see The Red Book – A Guide to Work Incentives.

You are required to report any changes to the SSA, including starting or stopping work, changes in pay, or an improvement in your medical condition. You can manage your benefits online through a “my Social Security” account.

Family Benefits and Health Coverage

If you receive SSDI, your family members may also be eligible for benefits. This can include a spouse who is over 62 or caring for your young child, and unmarried children under 18. You can learn about family benefits on the SSA’s website, including rules for surviving spouses, divorced spouses.

Health coverage is also a key component:

- SSDI recipients become eligible for Medicare after a 24-month waiting period (waived for ALS and ESRD).

- SSI recipients are typically eligible for Medicaid immediately.

Frequently Asked Questions about Disability Benefits

Here are straightforward answers to some of the most common questions about disability benefits.

Can I receive both SSDI and SSI at the same time?

Yes. This is known as receiving “concurrent benefits.” It typically happens when you are eligible for SSDI based on your work history, but your monthly payment is very low. SSI can then supplement your SSDI payment up to the federal benefit limit. A key advantage is that you may qualify for Medicaid immediately through SSI while waiting for Medicare coverage to begin. You can learn more about whether you can get SSI and SSDI benefits together.

How are disability benefits different from workers’ compensation?

The two programs serve different purposes.

- Social Security Disability (SSDI/SSI): A federal program for severe, long-term disabilities from any cause that prevent you from working.

- Workers’ Compensation: A state-run insurance program for injuries or illnesses that occurred specifically on the job.

You can sometimes receive both, but your SSDI benefits may be reduced if the combined total exceeds 80% of your pre-disability earnings.

Can my family members receive benefits?

Yes, if you receive SSDI, certain family members may also qualify for benefits based on your work record. This includes spouses, ex-spouses, and children who meet specific criteria. These auxiliary benefits provide additional support for your household and do not reduce your own payment. The SSA provides detailed information about family benefits and eligibility for surviving spouses, divorced spouses.

Conclusion

Navigating the disability benefits system is a complex and often frustrating journey. The requirements for SSDI and SSI are strict, the paperwork is extensive, and the waiting periods can be long. This is especially challenging when you are also managing a serious health condition.

This Disability benefits guide was created to provide a clear roadmap, but being informed is only the first step. Given that nearly 70% of initial applications are denied, many people find the process overwhelming.

An experienced disability attorney can dramatically improve your chances of success. They understand what evidence the SSA needs, how to build a strong case, and how to steer the appeals process. Having a professional advocate can make the difference between approval and denial.

At Tort Advisor, we connect people like you with top-rated attorneys specializing in disability law. You don’t have to face this journey alone. If you are ready to move forward with confidence, we can help you find expert legal support to fight for the benefits you deserve.

Free Confidential Case Evaluation

Complete the short form below to get an immediate FREE case review with an expert in your specific claim. Don't wait, your case could be time sensitive to file a claim.

Related Posts

Discover New Jersey disability benefits: TDI, FLI, SSDI, SSI rates, eligibility, applications & appeals for 2025-2026.

Hire a Depo-Provera lawsuit attorney now. Fight Pfizer for meningioma risks from injections. Free consult, MDL updates & settlements up to $1.5M.

Find top Miami florida car accident lawyers after your 305 crash. Get max compensation, navigate no-fault laws & choose the best experts now!

Diagnosed with cancer after Roundup? Learn about the monsanto roundup lawsuits, eligibility criteria, and how to pursue your claim.

Discover how do you qualify for a hair relaxer lawsuit: criteria, diagnoses, evidence & brands in uterine cancer MDL. Claim review now!

Find the best uber sexual assault lawsuit lawyer: expert guides, MDL experience, proven results & nationwide firms for justice.