Understanding the Importance of Motor Vehicle Accident Reports

If you need to obtain a motor vehicle accident report, here’s what you need to know:

| What You Need | Where to Get It | When to File |

|---|---|---|

| SR-1 Form (California) or state-specific form | State DMV website, police department, or insurance company | Within 5-10 days of accident (varies by state) |

| Police report number | Local police department or highway patrol | Request after accident is reported |

| Vehicle and driver information | Collected at accident scene | Document immediately after accident |

| Payment for report copy | Online portal or mail ($10-15 typical fee) | When requesting copy of report |

A motor vehicle accident report is an official document that records the details of a traffic collision, including driver information, vehicle data, accident circumstances, and often a determination of fault. This document serves as a critical legal record that impacts everything from your insurance claims to your driving record and potential legal proceedings. Every driver should understand that filing this report isn’t just a bureaucratic formality—it’s often a legal requirement with serious consequences if neglected.

According to statistics from the National Highway Traffic Safety Administration, every driver is likely to be involved in at least one vehicle collision during their lifetime, with 1 in 3 people being injured or killed in a vehicle collision. This sobering reality makes understanding accident reporting requirements essential knowledge for all drivers.

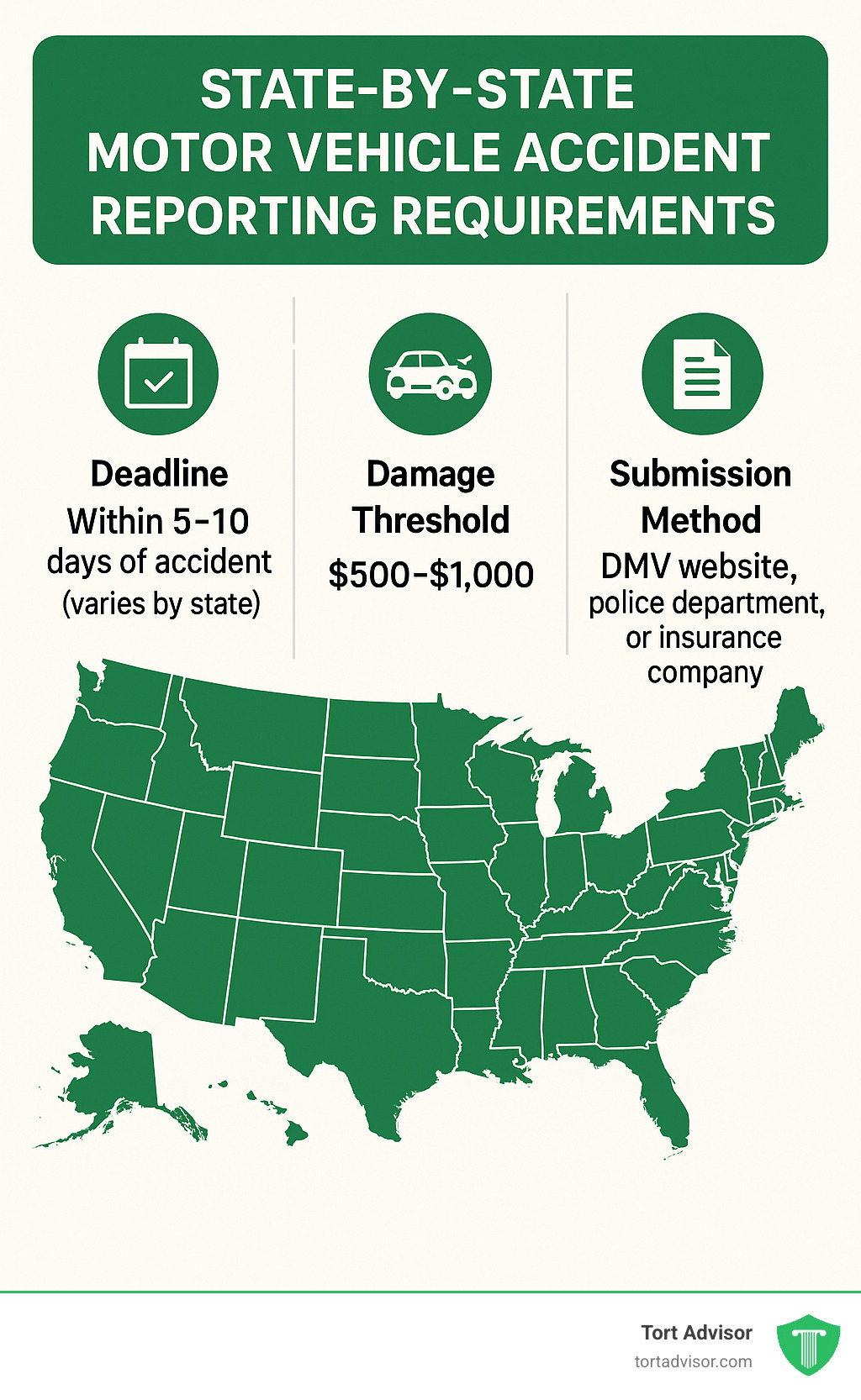

Most states require you to file an accident report when there’s:

- Any injury or fatality

- Property damage exceeding a certain threshold (typically $500-$1,000)

- Involvement of an uninsured driver

- Damage to government property

Failing to file a required accident report can result in serious consequences, including:

- License suspension

- Registration suspension

- Fines and penalties

- Insurance claim denials

- Difficulty establishing fault in legal proceedings

My name is Mason Arnao, and as a technology professional with experience in data management systems similar to those used for processing motor vehicle accident report information, I understand the critical importance of accurate documentation following traffic incidents.

Why This Guide Matters

The odds of being involved in a car accident during your lifetime are remarkably high. Statistics show that virtually every driver will experience at least one collision, with one in three people suffering injuries or fatalities in these incidents. These numbers aren’t meant to frighten you, but to emphasize why understanding accident reporting is crucial.

Beyond the statistical likelihood of being involved in an accident, there are serious compliance risks associated with improper reporting. In California, for example, failure to file a required SR-1 form within 10 days can result in the suspension of your driving privileges. Similar penalties exist in most states, making knowledge of proper reporting procedures not just helpful but essential.

Understanding Motor Vehicle Accident Reports

When you’re dealing with the aftermath of a car crash, paperwork might be the last thing on your mind. Yet a motor vehicle accident report is one of the most important documents you’ll need to handle. These reports come in different forms depending on where you live and what happened in your accident.

Think of these reports as the official storytellers of your accident. They might be filled out by a police officer who responded to the scene, by you for your state’s DMV, by your insurance company, or even on special federal forms if government vehicles were involved.

| Form Type | Primary Purpose | Who Completes It | Typical Deadline |

|---|---|---|---|

| SR-1 (California) | DMV notification | Driver | 10 days |

| SF-91 (Federal) | Government vehicle documentation | Federal employee | Immediately |

| MV-104 (New York) | DMV notification | Driver | 10 days |

| FLHSMV Form | Florida accident documentation | Driver | 10 days |

These aren’t just pieces of paper gathering dust in some filing cabinet. They create an official record that helps determine who’s responsible for what happened. They’re essential for insurance claims, might be needed in court, and even contribute to making our roads safer by helping identify dangerous intersections or road conditions.

While these reports contain personal information, they’re not open to just anyone. Generally, only the people involved, their attorneys, and insurance companies can access them. They’re an important piece of evidence when determining liability in a Motor Vehicle Accident.

What Is a Motor Vehicle Accident Report?

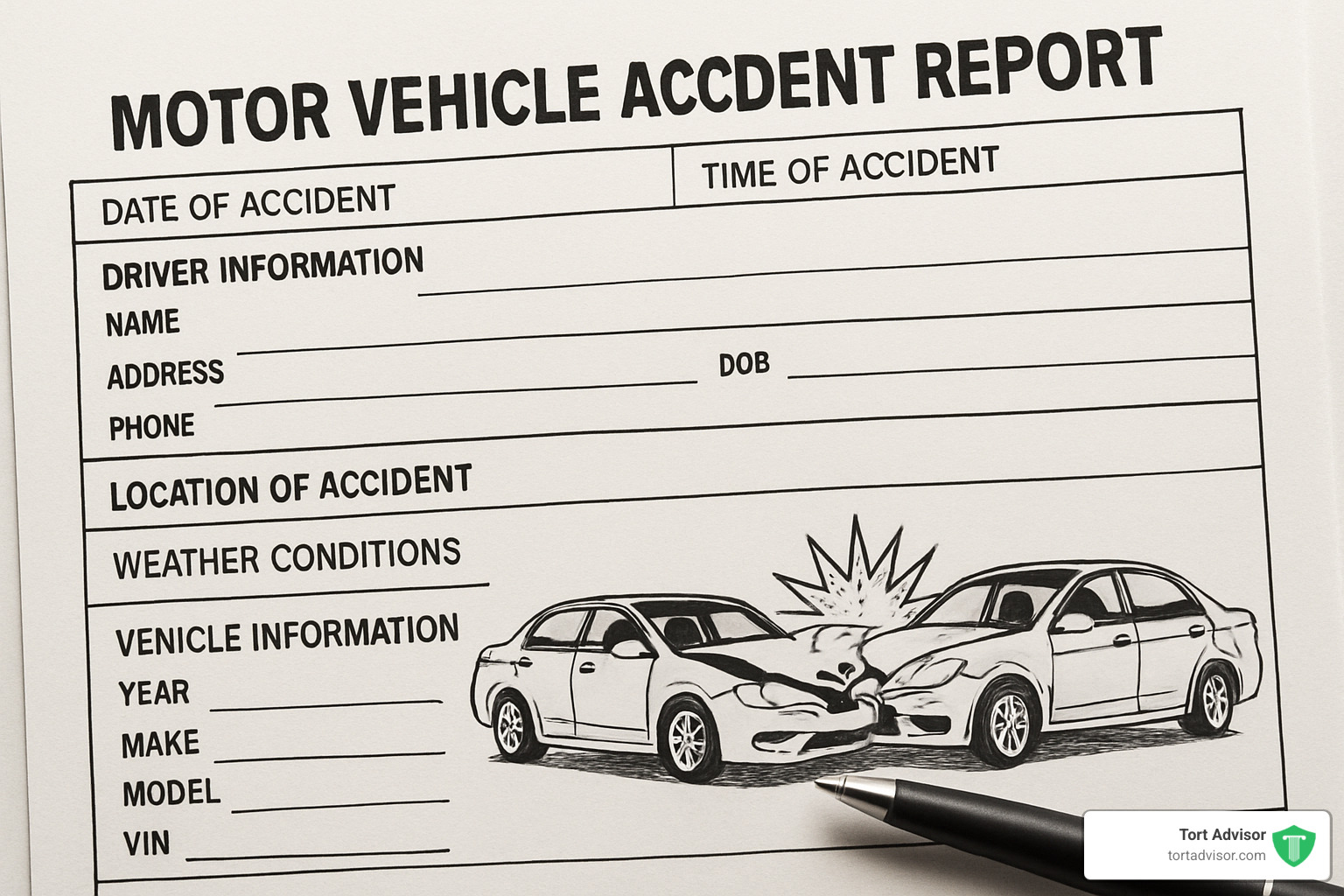

A motor vehicle accident report is basically the official story of what happened in your crash. Think of it as the who, what, when, where, and how of your accident, all documented in one place.

These reports typically include all the critical details: when and where the accident happened, what the weather and road conditions were like, who was involved (drivers, passengers, and vehicles), what kind of damage or injuries occurred, and often a diagram showing how the vehicles were positioned.

Many reports also include statements from drivers and witnesses, observations from the responding officer, and in some places, even preliminary thoughts on who might have been at fault.

Why a Motor Vehicle Accident Report Matters

You might wonder if it’s really worth the hassle to file a motor vehicle accident report. The short answer is absolutely yes, and here’s why:

First, it protects your driver’s license. In most states, skipping a required report can lead to your license being suspended. In California, for example, if you don’t submit an SR-1 form within 10 days of a qualifying accident, the DMV can put your driving privileges on hold.

Second, it’s essential for your insurance claim. Without this official documentation, insurance companies may delay or even refuse to cover your damages and injuries. The report provides an objective account that helps move your claim forward.

Your report also contributes to safer roads for everyone. These documents feed into databases that help identify dangerous intersections, problematic road designs, and traffic patterns that need fixing.

If your accident ends up in court, this report serves as a reliable record of what happened. Judges and juries often give significant weight to these official documents, making them crucial to your legal protection.

Who Has to File & When: Legal Rules and Deadlines

When the dust settles after a crash, figuring out who needs to file paperwork (and how quickly) can feel overwhelming. Generally, the responsibility for filing a motor vehicle accident report falls on the shoulders of:

- Drivers involved in the accident

- Vehicle owners (when the driver can’t file due to injuries)

- Employers (for accidents involving work vehicles)

- Government agencies (for incidents with government vehicles)

You’ll need to file a report when certain thresholds are crossed. Almost every state requires reporting when someone is injured or killed in an accident. Property damage thresholds vary widely from state to state – anywhere from $500 to $3,000 in damage can trigger mandatory reporting.

Hit-and-run incidents should always be reported, regardless of damage amount. This protects you legally and creates an official record of the incident. And if you’re driving a commercial vehicle, be aware that additional federal reporting requirements may apply beyond your state’s rules.

The clock starts ticking immediately after an accident. Some states require on-scene reporting for serious crashes, while others give you a grace period. Massachusetts only gives you 5 days to file, while California, Florida, and New York provide a more generous 10-day window. A few states allow up to 30 days for certain types of reports.

Missing these deadlines isn’t just a minor oversight – it can lead to serious consequences. In California, failing to submit your SR-1 form within 10 days can result in your license being suspended, even if you weren’t at fault! Other potential penalties include fines and registration holds that can create major headaches down the road.

State Deadlines at a Glance

Let’s look at reporting requirements for some of the most populous states:

In California, you have 10 days to file an SR-1 form for accidents involving injury, death, or property damage exceeding $1,000.

Massachusetts gives you just 5 days to report accidents with injury, death, or property damage over $1,000.

Florida requires filing within 10 days when there’s injury, death, or property damage over $500.

New York drivers must submit an MV-104 form within 10 days for accidents involving injury, death, or property damage over $1,000.

Wisconsin has no state-mandated reporting requirement, though your insurance policy will likely still require prompt notification.

Remember – even if police responded and created their own report, you’re still typically required to file with your state’s DMV.

Special Rules for Government & Commercial Fleets

If you’re driving a government vehicle or commercial truck, additional reporting requirements apply that go beyond what regular drivers face.

Government vehicle operators must complete Standard Form 91 (SF-91) after an accident. Federal agencies trigger investigator involvement when property damage hits just $500 – a lower threshold than many states set for civilian drivers.

For commercial drivers, the stakes are even higher. If you hold a Commercial Driver’s License (CDL), you must notify your employer immediately following any accident. CDL holders face stricter reporting requirements because they’re held to higher safety standards. Federal regulations mandate additional documentation for commercial vehicle accidents, and most employers have their own internal reporting procedures that must be followed alongside government requirements.

How to Obtain, Read, and Use Your Motor Vehicle Accident Report

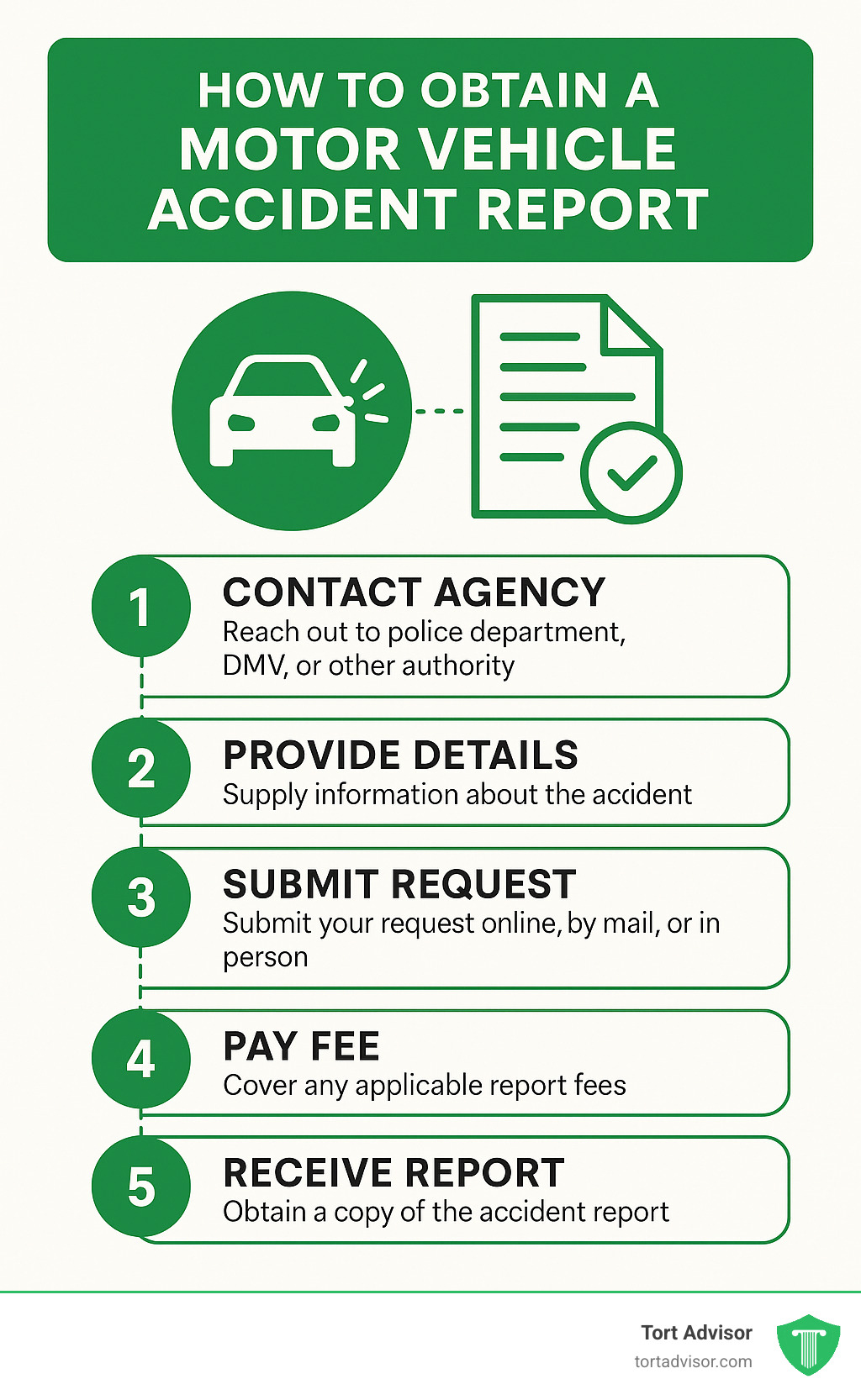

So you’ve been in an accident and now you need to get your hands on the official report. Don’t worry – it’s easier than you might think! Whether you need it for insurance claims, legal matters, or just for your personal records, here’s how to steer the process with minimal headache.

Getting a Copy Fast

The digital age has made accessing your motor vehicle accident report much simpler than in years past. Most states now offer convenient online options that can save you time and frustration:

Online portals are typically your fastest route to getting a copy. You can usually access reports through your state’s DMV website, local police department portals, or even through third-party providers like LexisNexis BuyCrash that gather reports from multiple jurisdictions.

For example, if you’re in Florida, you can request your report directly through the Florida Highway Safety and Motor Vehicles (FLHSMV) website. California residents can access their reports through the state’s DMV portal.

When requesting your report, keep in mind that most agencies charge a fee of $10-15 per report. Some jurisdictions also have a 60-day waiting period for people who weren’t directly involved in the accident. You’ll need to provide basic information like your name, date of birth, and the report number.

If you prefer the old-school approach, you can still request reports by mail or in person. Just be prepared with the accident date and location, names of involved parties, your relationship to the accident, and payment for any fees.

How a Motor Vehicle Accident Report Impacts Insurance

That little report packs a big punch when it comes to your insurance situation. Here’s why it matters so much:

Your motor vehicle accident report directly influences your premium rates. Accidents documented in official reports typically appear on your driving record, which insurers review when calculating your premiums. If you’re found at fault, you can expect some unwelcome news when your policy renews.

The fault determination in your report carries significant weight. In California, for instance, every collision reported to the DMV by law enforcement will show on your record unless the officer specifically indicates someone else was at fault. Insurance companies rely heavily on these official determinations when deciding who pays for damages.

The details in your report – everything from damage descriptions to injury notes and contributing factors – directly shape how your claim is processed. Insurance adjusters pore over these reports, looking for information that helps them assess liability and coverage.

Correcting or Supplementing a Motor Vehicle Accident Report

We all make mistakes – and sometimes, so do the people filling out accident reports. If you spot errors or omissions in your motor vehicle accident report, you generally have options to set the record straight:

Many states offer specific forms designed for correcting information in accident reports. In California, you can submit a written statement that gets attached to your SR-1 form. Some jurisdictions require notarized statements detailing the corrections needed.

You may also be able to add photographs, witness statements, or other evidence that wasn’t available when the original report was filed. This can be particularly helpful if new information has come to light since the accident.

Be aware that there’s usually a clock ticking – most states impose deadlines for corrections, typically ranging from 30 days to one year after the original filing. The exact process varies by state, so it’s best to contact your local DMV or the agency where you filed the original report for specific procedures.

Avoiding Mistakes & Pro Tips at the Crash Scene

The chaotic moments after a collision can leave even the calmest person feeling overwhelmed. Yet what you do in those first few minutes directly shapes how smoothly your motor vehicle accident report process will go later.

Top 5 Reporting Mistakes

Missing deadlines is the most common reporting mistake people make. In the stress following an accident, it’s easy to forget that clock is ticking on your state’s filing deadline. Set a calendar reminder immediately after the accident—your future self will thank you.

Using incorrect insurance information creates unnecessary headaches. Those three-digit NAIC codes on California forms might seem like minor details, but using the wrong ones can delay your entire claim. Always copy information directly from current insurance cards rather than relying on memory.

When it comes to diagrams, vague sketches lead to misunderstandings. Take your time with this part—use the standardized symbols provided and be as precise as possible about vehicle positions and movements.

Believe it or not, motor vehicle accident reports get rejected simply because people forget to sign them. It sounds simple, but in your rush to file, double-check that you’ve signed in all required places. A missing signature can set you back to square one.

Many drivers focus solely on vehicle damage and overlook other property impacts. That damaged guardrail, fence, or utility pole needs to be documented too. Even minor property damage should be recorded—it might become important later in the claims process or if you’re dealing with common motor vehicle accident injuries.

Scene Checklist to Simplify Your Future Report

Your smartphone is your best friend at an accident scene. Before leaving, take clear photos from multiple angles showing all vehicles and damage. Capture the broader scene too—road conditions, traffic signs, weather conditions, and any physical evidence like skid marks or debris. These visual records often capture details your memory might miss.

Exchanging information feels awkward, but be thorough. Beyond the basics of names and phone numbers, collect driver’s license details, complete addresses, and birth dates. For vehicles, note down license plates, makes, models, years, and if possible, those long Vehicle Identification Numbers (VINs). Insurance information is critical—company names, policy numbers, those NAIC codes I mentioned, and effective dates.

Don’t overlook witnesses. In the confusion, it’s easy to let potential witnesses walk away, but their perspectives can be invaluable. Collect names and contact information from anyone who saw what happened, along with brief notes about their observations.

If police respond, get the officer’s name, badge number, and agency. Most importantly, ask for the report or incident number and instructions on how to obtain the police report later. This information will save you hours of phone calls when you need to reference the official report.

Frequently Asked Questions about Motor Vehicle Accident Reports

Do I still need to file if police wrote a report?

Yes, you absolutely need to file your own motor vehicle accident report with the DMV in most states, even when police officers have already created their own report at the scene. It’s a common misconception that the police report eliminates your personal filing responsibility—but these are actually two separate systems serving different purposes.

Think of it this way: police reports focus on potential traffic violations and criminal aspects, while your DMV report addresses your administrative obligations as a licensed driver.

In California, the DMV makes this crystal clear: “even if a law enforcement officer or California Highway Patrol files a report, you must file this DMV report.” Many clients face unnecessary complications simply because they assumed the responding officer’s paperwork was sufficient.

The rare exception? When an officer specifically tells you they’ve filed the DMV report on your behalf—but don’t count on this happening, as it varies widely by jurisdiction and officer.

Who can legally view my motor vehicle accident report?

Your motor vehicle accident report isn’t available to just anyone who’s curious. States have established privacy protections that limit access to specific parties with legitimate interests:

People directly involved in the accident (you, other drivers, passengers, and property owners) can always access the report. Your legal representatives and insurance companies also have legitimate access rights, as do relevant government agencies like courts and regulatory bodies.

Florida’s state law (Florida §316.066) takes privacy a step further by implementing a 60-day cooling-off period where only those directly involved and their representatives can access crash reports. Similarly, California’s Vehicle Code §16005 restricts public disclosure while allowing certain necessary parties to inspect records.

If you’re worried about your personal information being exposed, you’ll be relieved to know that most states require sensitive details to be redacted before releasing reports to third parties. Your social security number, for example, wouldn’t be visible to someone without a legitimate need to see it.

What happens if I miss the deadline?

Missing your motor vehicle accident report filing deadline can create a cascade of unwelcome consequences. The severity varies by state, but none of the outcomes are pleasant.

In California, the DMV doesn’t take missed deadlines lightly—they can suspend your driving privilege for failing to file an SR-1 within the required 10 days. Imagine losing your ability to legally drive simply because you procrastinated on paperwork!

Beyond license suspension, you might face monetary penalties, insurance claim complications (including potential denials), and significant difficulties establishing who was at fault if disputes arise later. Without a timely official record, your version of events carries less weight.

Conclusion

Let’s face it—dealing with motor vehicle accident reports isn’t anyone’s idea of fun, especially when you’re already shaken up from a collision. But understanding these documents isn’t just bureaucratic busywork—it’s a crucial step in protecting yourself legally and financially.

Remember these essentials as you move forward:

- Know your state’s specific requirements like the back of your hand. California gives you 10 days, Massachusetts only 5—and missing these deadlines can have serious consequences for your driving privileges.

- Take those extra few minutes at the accident scene to document everything thoroughly. Your future self will thank you when you’re filling out forms later and have all the information at your fingertips.

- File your reports promptly—I can’t stress this enough. Too many people face license suspensions and claim denials simply because they procrastinated on paperwork.

- Keep copies of everything. Snap photos of completed forms, scan documents, and create a dedicated folder on your computer or phone. When questions arise weeks or months later, you’ll be glad you did.

And perhaps most importantly, don’t hesitate to ask for help when you need it. Even the most organized person can feel overwhelmed after an accident.

At Tort Advisor, we understand that proper accident reporting is just one piece of the puzzle. Our network connects you with attorneys who specialize in motor vehicle accidents—professionals who have steered these waters countless times and know exactly how to guide you through the process.

If you’re struggling with report requirements or facing consequences from improper filing, we can match you with attorneys who have proven track records with cases just like yours. We’re selective about our attorney network because we believe you deserve representation from someone who truly knows their stuff.

For more information about how we can help you find the right attorney for your situation, visit our Car Accident Lawsuits page.

The motor vehicle accident report might seem like just another form, but it’s often the cornerstone of your entire case. Take it seriously, complete it carefully, and you’ll have laid the groundwork for whatever comes next—whether that’s an insurance claim or legal action.

You don’t have to figure it all out alone. We’re here to help you find the legal guidance you need, when you need it most.

Internal reference code (please disregard): xQ27vPl93zB

Free Confidential Case Evaluation

Complete the short form below to get an immediate FREE case review with an expert in your specific claim. Don't wait, your case could be time sensitive to file a claim.

Related Posts

Did a North Dakota product cause harm? Understand product liability, your rights, and how to take action for defects.

Get justice for clergy abuse. Find an expert Priest abuse lawyer to navigate complex laws and hold institutions accountable.

Diagnosed with meningioma after Depo-Provera? Understand potential Depo-Provera lawsuit settlements, risks, & how to claim compensation.

Uncover the truth about uber sexual assault cases. Learn about the alarming scale, Uber's accountability, and legal options for justice.

Facing wildfire losses? Discover the best wildfire lawsuit attorneys in California to fight for your full recovery and justice.

Exposed to Roundup & diagnosed with NHL? Discover how to sue Monsanto, understand eligibility, & seek compensation. Your guide to justice.