Why Understanding SSDI Eligibility Rules Matters for Your Financial Security

SSDI eligibility rules determine who can receive Social Security Disability Insurance, a federal program providing monthly payments to workers unable to work due to a serious medical condition. Qualifying depends on two core requirements:

- Work History: You must have enough work credits from paying Social Security taxes. Generally, this means 40 credits total, with 20 earned in the last 10 years.

- Medical Disability: Your condition must be severe enough to prevent you from doing substantial work, last at least 12 months, or be expected to result in death. You cannot be earning above the Substantial Gainful Activity (SGA) limit (in 2025, $1,620/month or $2,700 if blind) when you apply.

SSDI is a critical financial safety net, but the path to approval is difficult. The Social Security Administration (SSA) denies about two-thirds of initial applications, and less than a third of applicants are ultimately approved, even after appeals. The complexity comes from strict federal rules combining work history, medical evidence, and vocational factors like age and education.

The stakes are high. For many, SSDI is the difference between financial stability and poverty. With the average monthly benefit around $1,352 in late 2023, these funds are vital. Understanding the rules is essential, as roughly one in three young workers may face a disability before retirement age.

This guide breaks down the SSDI eligibility rules into clear information. We’ll cover work credits, medical criteria, the SSA’s 5-step evaluation, and special rules for different situations. We will also clarify the key differences between SSDI and Supplemental Security Income (SSI).

Understanding the Two Pillars of SSDI Eligibility

SSDI eligibility rules rest on two pillars: your work history and your medical condition. You must meet both requirements to qualify for benefits. Think of it as first proving you’ve earned the right to apply, and second, demonstrating your medical need.

Work History: Earning Your Insured Status

SSDI is an insurance benefit you pay for through Social Security (FICA) taxes on your earnings. The SSA tracks these contributions using a system of work credits. In 2025, you earn one credit for every $1,810 in income, up to a maximum of 4 credits per year. You can learn more about How You Earn Credits from the SSA.

To have “insured status,” you must pass two tests:

- The Recent Work Test: This checks if you’ve worked recently enough. Most adults need 20 credits earned in the 10 years before their disability began, a standard known as the 20/40 Rule. This ensures the program serves recently active workers.

- The Duration of Work Test: This looks at your total credits. Most people need 40 credits (about 10 years of work). However, special rules for younger workers exist. For example, if you become disabled before age 24, you may only need 6 credits earned in the prior 3 years.

You can easily check your status by creating a free online account to Check your work history on the Social Security website.

Medical Requirements: The SSA’s Definition of Disability

While work credits open the door, your medical condition is the key to approval. The SSA’s definition of disability is far stricter than many expect. It does not recognize partial or short-term disability; you must prove total disability.

Your condition must meet three criteria:

- It prevents you from performing Substantial Gainful Activity (SGA). In 2025, SGA is defined as earning more than $1,620 per month ($2,700 if blind). Earning above this limit will likely lead to a denial. You can find More on SGA from the SSA.

- Your condition must last 12 months or be expected to result in death. A serious injury that will heal in six months won’t qualify.

- It must prevent you from doing any substantial work that exists in the national economy, not just your previous job. The SSA will consider if you could perform a less demanding role, like a desk job, even if you have no experience in that field.

Your condition is evaluated based on objective medical evidence, including records, treatment history, and doctor’s opinions. Your claim must be backed by solid documentation showing how your condition limits basic work activities like standing, lifting, sitting, or concentrating.

The 5-Step Evaluation Process: How the SSA Decides Your Claim

Your SSDI application goes through a sequential five-step evaluation process conducted by state agencies called Disability Determination Services (DDS). At each step, an examiner asks a specific question. If the answer leads to a denial, the process stops. Understanding these steps can help you build a stronger claim.

Step 1 & 2: Current Work Activity and Severity

The first two steps are initial filters.

- Step 1: Are you working? The SSA checks if you are engaged in Substantial Gainful Activity (SGA). In 2025, this means earning over $1,620 per month ($2,700 if blind). If you are, your claim will likely be denied. You can Estimate your potential benefits with our SSDI Benefit Calculator.

- Step 2: Is your condition “severe”? Your impairment must significantly limit basic work-related activities, such as walking, lifting, sitting, remembering, or concentrating. If your condition is considered non-severe, your claim is denied.

Step 3: The Listing of Impairments (Blue Book)

At this step, the DDS compares your condition to the SSA’s “Listing of Impairments,” also known as the Blue Book. This manual contains specific medical criteria for conditions that are considered severe enough to prevent a person from working. You can review the List of qualifying medical conditions.

If your condition meets or medically equals a listing, you will be found disabled. “Meeting” a listing means your medical evidence matches the exact criteria. “Equaling” a listing means your condition is as severe as a listed impairment, which is important for those with multiple health issues. The SSA also has fast-track programs like Compassionate Allowances (CAL) and Quick Disability Determinations (QDD) for the most serious cases, allowing for decisions in weeks instead of months.

Step 4 & 5: Past Work and Other Work Capabilities

If your condition doesn’t meet a listing, the evaluation continues to the final two steps, which consider your age, education, and work history, known as vocational factors.

- Step 4: Can you do your past work? The SSA assesses if your limitations prevent you from performing any of the jobs you held in the last 15 years. If you can still do your past work, your claim will be denied.

- Step 5: Can you do any other type of work? If you cannot do your past work, the SSA determines if you can adjust to other work that exists in the national economy. Your age, education, and transferable skills are critical here. The SSA has more lenient standards for older workers (age 50+), as it’s harder for them to adapt to new jobs. For those 50 and over, the SSA often uses the Medical-Vocational Guidelines (Grid Rules), a matrix that can direct a finding of “disabled” based on your vocational profile and physical limitations.

Many claims are won or lost at this final step, where strong medical evidence and legal representation can be crucial.

Navigating the SSDI Application and Special Rules

Understanding the application process and special eligibility rules can make a significant difference in your claim.

Applying for Benefits: Process and Timeline

The SSDI application process requires patience and thorough documentation. Before you apply, gather the following:

- Your Social Security number and proof of age.

- Contact information for all doctors, hospitals, and clinics that have treated you, including dates.

- Your medical records, including test results, imaging, and a list of medications.

- Your work history, including job types and duties, plus recent W-2s or tax returns.

You can apply online, by phone, or in person. The online application at Apply for benefits online is often the most convenient. You can also call the SSA at 1-800-772-1213 or visit a local office.

After you apply, the SSA confirms your work credits, then sends your case to your state’s Disability Determination Services (DDS) for a medical review. Be prepared for a long wait; the average initial decision took over seven months in 2023. If approved, there is a mandatory five-month waiting period before benefits start. However, you may be eligible for retroactive benefits for up to 12 months prior to your application date.

Since most initial applications are denied, it’s important to know What to do if you receive a Denied Disability Claim.

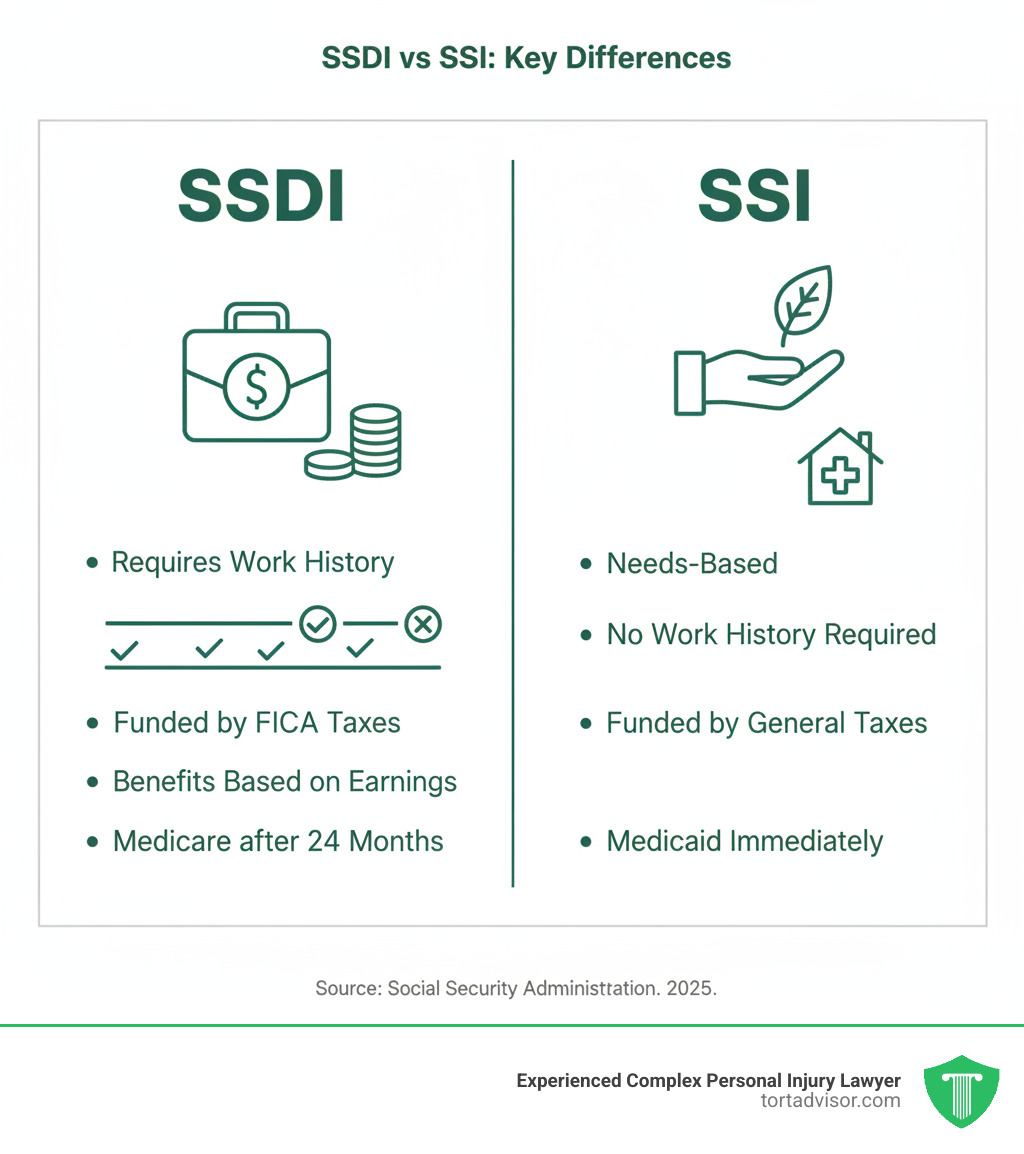

SSDI vs. SSI: What’s the Difference?

People often confuse SSDI and SSI. They are two different programs:

- SSDI (Social Security Disability Insurance): An insurance program you earn by paying Social Security taxes. Your benefit is based on your earnings history, and you become eligible for Medicare after 24 months of receiving benefits.

- SSI (Supplemental Security Income): A needs-based program funded by general tax revenues. It does not require a work history, but you must have very limited income and assets (e.g., under $2,000 for an individual). Benefits are a standard federal rate, and you typically qualify for Medicaid immediately.

It is possible to receive both (“concurrent benefits”) if your SSDI payment is low and you meet SSI’s financial limits. You can Learn more about and compare SSDI and SSI benefits.

Special SSDI Eligibility Rules for Family and Unique Situations

SSDI also has provisions for families and other specific circumstances:

- Family Benefits: If you are approved for SSDI, your spouse (if caring for a child under 16) and unmarried children under 18 may also qualify for benefits on your record. Learn about family benefits.

- Surviving Spouses: A disabled widow or widower between ages 50 and 60 may be eligible for benefits on their deceased spouse’s record.

- Disabled Adult Child (DAC): An adult who became disabled before age 22 may qualify for benefits on a parent’s Social Security record.

- Blind or Low Vision: The SSA has special rules for blind individuals, including a higher SGA limit of $2,700 per month in 2025.

- Incarceration: SSDI benefits are generally suspended if you are incarcerated for more than 30 days.

Frequently Asked Questions about SSDI Eligibility Rules

Navigating SSDI eligibility rules can be confusing. Here are answers to some common questions.

How does returning to work affect my SSDI benefits?

The SSA provides “work incentives” to help you return to work without immediately losing benefits.

- Trial Work Period (TWP): You get nine months (not necessarily consecutive) to earn any amount of money while still receiving your full SSDI benefits. This lets you test your ability to work without risk.

- Extended Period of Eligibility (EPE): After the TWP, you have a 36-month EPE. During this time, you’ll receive benefits for any month your earnings are below the Substantial Gainful Activity (SGA) limit ($1,620/month in 2025, or $2,700 if blind). If you earn above SGA, your benefits are suspended but can be easily reinstated if your earnings drop again within the EPE.

You must report all work and earnings to the SSA to avoid overpayments. The SSA offers guidance on How returning to work could affect your eligibility.

What happens if my SSDI application is denied?

Most initial SSDI applications are denied, but a denial is not the end of the road. You have the right to appeal. The appeals process has four levels:

- Reconsideration: A new examiner reviews your file and any new evidence you submit.

- Hearing by an Administrative Law Judge (ALJ): This is a crucial step where many claims are won. You can testify in person about how your disability affects you.

- Appeals Council: The council reviews the ALJ’s decision for legal errors.

- Federal District Court: The final step is to file a lawsuit in federal court.

The appeals process is complex and lengthy. Seeking legal help can significantly improve your chances of success. Tort Advisor provides Disability Claim Assistance to guide you. You can also Learn how you can appeal a denial from the SSA.

How are SSDI benefits paid and when do I get them?

Approved SSDI benefits are paid monthly, usually via direct deposit. The payment date depends on your birthday:

- 1st-10th of the month: Second Wednesday

- 11th-20th of the month: Third Wednesday

- 21st-31st of the month: Fourth Wednesday

You can view the schedule here: Find out when you will receive your benefits.

That SSDI benefits may be taxable depending on your total household income. While many recipients’ incomes are below the taxable threshold, it’s important to be aware of this possibility.

Conclusion: Securing the Benefits You’ve Earned

Navigating SSDI eligibility rules is a complex journey. From work credits and medical criteria to the five-step evaluation, the process is detailed and demanding. However, understanding these rules is the first step toward securing the benefits you have earned through years of work.

The application process is often long, and initial denial rates are high. It’s easy to feel discouraged, but persistence is key. Many applicants who are initially denied are ultimately approved on appeal, especially at the hearing level. Don’t give up if your claim is rejected.

You don’t have to face this challenge alone. If your claim has been denied or you feel overwhelmed, the experienced attorneys at Tort Advisor can provide the Disability Claim Assistance you need. We connect clients with top-rated disability lawyers who have a proven track record of success. Our network spans the entire country, including attorneys in Alabama, Arizona, California, Florida, Illinois, and many other states.

You paid into the Social Security system for this protection. When a disability prevents you from working, let us help you secure the financial stability you deserve. For help with a Denied Disability Claim or for general Disability Claim Assistance, contact us today.

Free Confidential Case Evaluation

Complete the short form below to get an immediate FREE case review with an expert in your specific claim. Don't wait, your case could be time sensitive to file a claim.

Related Posts

Did a North Dakota product cause harm? Understand product liability, your rights, and how to take action for defects.

Get justice for clergy abuse. Find an expert Priest abuse lawyer to navigate complex laws and hold institutions accountable.

Diagnosed with meningioma after Depo-Provera? Understand potential Depo-Provera lawsuit settlements, risks, & how to claim compensation.

Uncover the truth about uber sexual assault cases. Learn about the alarming scale, Uber's accountability, and legal options for justice.

Facing wildfire losses? Discover the best wildfire lawsuit attorneys in California to fight for your full recovery and justice.

Exposed to Roundup & diagnosed with NHL? Discover how to sue Monsanto, understand eligibility, & seek compensation. Your guide to justice.