Why Applying for Social Security Disability Insurance Online Can Speed Up Your Claim

Social Security Disability Insurance (SSDI) provides monthly cash benefits to workers who can no longer work due to a severe, long-term medical condition. If you’ve paid Social Security taxes and are unable to work, SSDI may provide the financial support you need.

Quick Answer: How to Apply for SSDI Fast

- Check eligibility with the SSA’s online questionnaire.

- Gather documents like medical records and work history.

- Apply online at www.ssa.gov/benefits/disability.

- Submit a complete application with all supporting evidence.

- Expect a 3-6 month wait for an initial decision.

The online application is faster than mail and lets you save your progress. While the average disabled worker’s benefit was $1,483 in early 2023, nearly 70% of initial applications are denied. This makes a thorough, well-documented claim critical from the start.

SSDI requires you to be unable to perform substantial gainful activity (earning over $1,470/month in 2023) due to a medical impairment expected to last at least 12 months or result in death. It does not cover partial or short-term disabilities. This guide will walk you through the fastest way to apply for SSDI benefits using the SSA’s digital tools.

Find more about Social Security Disability Insurance:

Before You Apply: Use Online Tools to Check Your Eligibility

Before starting the application, ensure you qualify for Social Security Disability Insurance. SSDI is an earned insurance benefit based on your work history and the Social Security taxes (FICA) you’ve paid.

The Social Security Administration (SSA) uses a system of “work credits” based on your annual income. In 2024, you earn one credit for each $1,730 in income, up to four per year. Most adults need 40 credits, with 20 earned in the last 10 years before their disability began. Younger workers may qualify with fewer credits. The SSA uses a recent work test and a duration of work test to evaluate your history.

Beyond work credits, you must meet the SSA’s strict definition of disability. Your condition must prevent you from engaging in Substantial Gainful Activity (SGA), which means earning more than $1,470 per month (in 2023). Your medical condition must also be “medically determinable” and expected to last at least 12 months or result in death. SSDI does not cover partial or short-term disabilities.

To get a quick idea of your eligibility, the SSA offers a free online benefits questionnaire. It takes a few minutes and provides a preliminary assessment. Use the Social Security benefits questionnaire to get started.

Key Eligibility for Social Security Disability Insurance

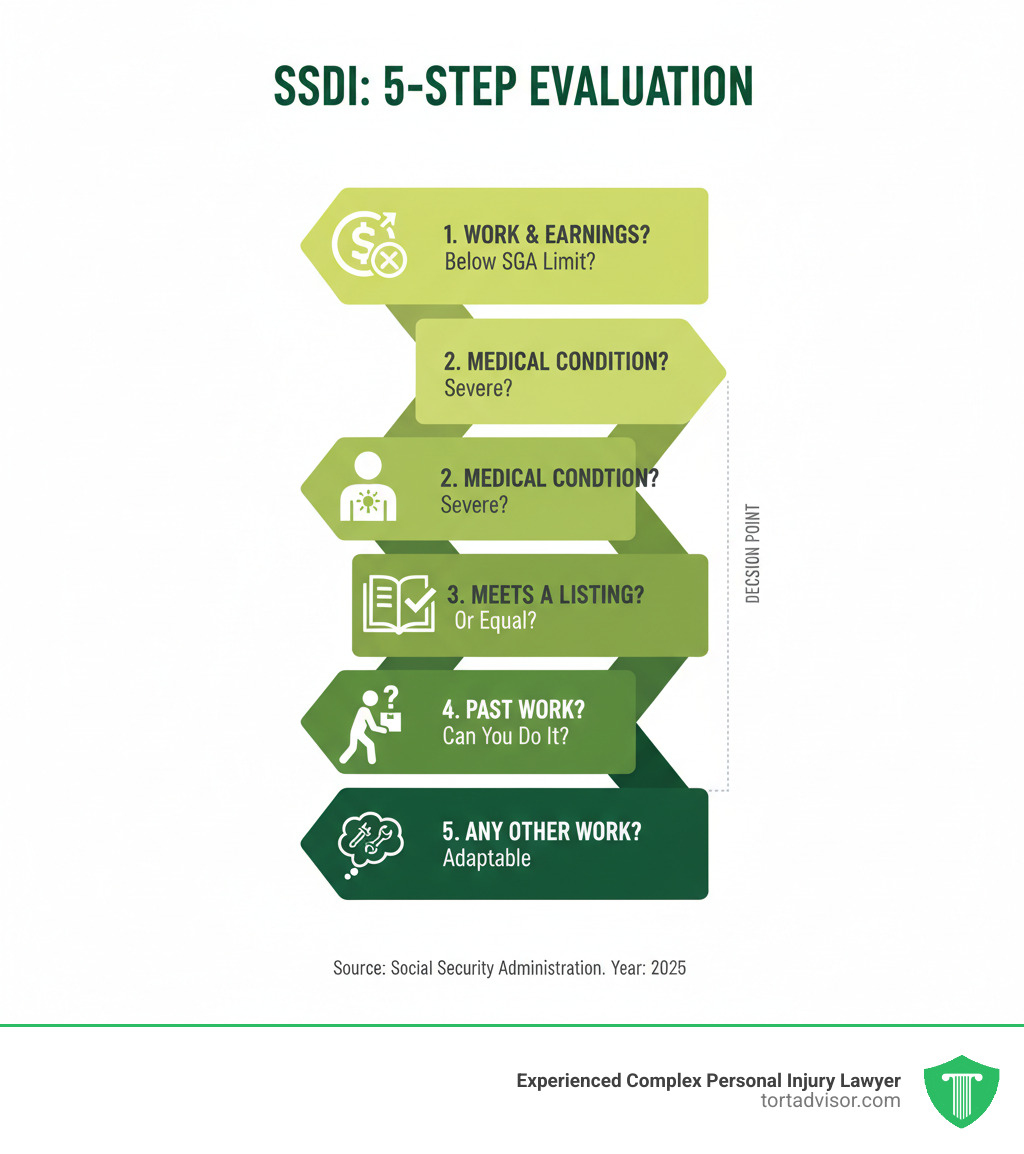

The SSA uses a five-step sequential evaluation process to determine if you are disabled:

Step 1: Are you working? If you’re earning above the SGA limit ($1,470/month for 2023), your claim will likely be denied.

Step 2: Is your medical condition severe? Your impairment must significantly limit basic work activities (walking, sitting, remembering) and be expected to last 12 months or result in death.

Step 3: Does your condition meet or equal a listing? The SSA’s “Listing of Impairments” (or “Blue Book”) contains conditions severe enough to automatically qualify for benefits. If your condition is on this list, you are generally approved.

Step 4: Can you do your past work? If your condition isn’t on the list, the SSA assesses if you can perform any of your jobs from the past 15 years, considering your limitations.

Step 5: Can you adjust to other work? The SSA considers your Residual Functional Capacity (RFC), age, education, and experience to see if you can perform other jobs in the national economy. The older you are, the harder it is for the SSA to argue you can learn new work.

This process shows that a medical diagnosis alone is not enough; the focus is on your inability to work.

SSDI vs. SSI: A Quick Comparison

Many people confuse Social Security Disability Insurance (SSDI) with Supplemental Security Income (SSI). SSDI is an earned insurance benefit based on your work history and FICA tax payments. SSI is a needs-based program for individuals with limited income and resources, funded by general tax revenues.

Here’s how they compare:

| Feature | Social Security Disability Insurance (SSDI) | Supplemental Security Income (SSI) |

|---|---|---|

| Funding Source | Payroll taxes (FICA) | General tax revenues |

| Eligibility Criteria | Disability and sufficient work history. No income/resource limits. | Disability (or 65+/blind) and limited income/resources. No work history needed. |

| Benefit Calculation | Based on average lifetime earnings. | Federal benefit rate, reduced by countable income. |

| Health Coverage | Medicare after a 24-month waiting period. | Medicaid, usually available immediately. |

| Means-Tested | No | Yes |

Learn more about and compare SSDI and SSI benefits.

Because SSDI is an earned benefit, there are no limits on your assets. SSI has strict resource limits (generally $2,000 for an individual). It is possible to receive concurrent benefits from both programs if your SSDI payment is low and you meet SSI’s financial requirements.

Step-by-Step: How to Apply for Social Security Disability Insurance Online

Applying for Social Security Disability Insurance can be challenging, but the online application is the fastest and most efficient method. While you can apply by phone (1-800-772-1213) or at a local office, the online portal lets you work at your own pace, save your progress, and submit everything electronically.

Ready to get started? Here’s where you’ll begin: Find out how to apply for SSDI.

Gather Your Documents: What You’ll Need

Before you begin, get organized. A complete application moves through the system much faster. Missing information causes delays as the SSA must contact you for details.

Here’s a list of what you’ll need:

- Personal Information: Your Social Security number and birth certificate. Information for your spouse and minor children (birth dates, SSNs). Marriage/divorce dates.

- Military Service: Your DD Form 214 if you served.

- Employment Details: Names and addresses of employers for the last 15 years, dates of employment, and earnings. Your W-2s or self-employment tax returns for the last two years.

- Medical Records: This is crucial. List the names, addresses, and phone numbers for all doctors, hospitals, and clinics that have treated you. Include patient ID numbers, treatment dates, a list of your medications, and dates of medical tests (X-rays, MRIs, etc.).

- Work History: A detailed description of your job duties over the past 15 years. The SSA needs to understand the physical and mental demands of your past work.

Completing the Online Application

First, create a “my Social Security” account at www.ssa.gov/myaccount. This portal is where you will apply and later manage your benefits, check your status, and update your information. Manage your benefits online and: take advantage of these features.

The online application consists of several parts:

- Adult Disability Report: This is the core of your application. You will describe your medical condition, how it limits your ability to work, your medical treatments, and your work history. Be thorough and honest.

- Work History Report: This form asks for specific details about your past jobs, such as lifting requirements, hours spent standing, or supervisory duties.

- Authorization to Release Medical Records: This gives the SSA permission to obtain your records directly from your healthcare providers. Ensure all contact information is current to avoid delays.

Before submitting, review everything carefully for typos or missing information. The online portal allows you to save your progress and return later, which is helpful for this detailed and sometimes draining process.

Understanding the Timeline, Benefits, and Next Steps

After you submit your Social Security Disability Insurance application, the waiting begins. The process is not quick, but understanding the timeline can help manage expectations.

On average, an initial decision takes three to six months. This can extend if the SSA needs more information. If you are approved, there is a mandatory five-month waiting period before cash benefits begin. For example, if your disability began January 15th, your first payment would be for July (received in August). This waiting period is waived for individuals with ALS.

Medicare coverage also involves a wait. Most SSDI recipients become eligible for Medicare 24 months after their disability cash benefits start, which is typically 29 months from the onset of disability. Exceptions exist for those with ALS or end-stage renal disease (ESRD).

These timelines can be daunting. If you need help navigating the process, our network of attorneys specializes in Disability Claim Assistance and can provide guidance.

Calculating Your Social Security Disability Insurance Payments

Your Social Security Disability Insurance payment is not a fixed amount; it’s calculated based on your lifetime earnings history. The SSA uses a formula based on your Average Indexed Monthly Earnings (AIME) to determine your Primary Insurance Amount (PIA), which is your monthly benefit. The more you earned and paid into Social Security, the higher your benefit will be.

In early 2023, the average monthly SSDI benefit for a disabled worker was $1,483. However, your amount will be specific to your record. For a personalized estimate, use our free SSDI Benefit Calculator.

What Other Benefits Are Available?

Beyond a monthly check, SSDI includes other valuable benefits.

- Medicare Coverage: You automatically qualify for Medicare after receiving SSDI benefits for 24 months.

- Family Benefits: Your spouse (if over 62 or caring for your child under 16) and unmarried children (under 18, or disabled before 22) may be eligible for benefits on your record. These are capped by a family maximum. You can learn about family benefits on the SSA’s website.

- Cost-of-Living Adjustments (COLAs): Your benefits are typically increased annually to keep pace with inflation.

- Conversion to Retirement Benefits: When you reach full retirement age, your disability benefits automatically convert to retirement benefits, usually at the same amount.

What to Do If Your Application Is Denied

Nearly 70% of initial Social Security Disability Insurance applications are denied. If you receive a denial letter, don’t be discouraged. A denial is not the end of your case, and many successful claims are won on appeal.

Common reasons for denial include:

- Insufficient medical evidence to prove the severity and duration of your disability.

- Earning above the Substantial Gainful Activity (SGA) limit ($1,470/month in 2023).

- Failure to follow prescribed medical treatment without a good reason.

- Incomplete or incorrect information on the application.

If denied, you have 60 days from the date on your denial letter to file an appeal. Missing this deadline usually means you must start the entire application process over. Your chances of approval often increase at later stages of the appeal, especially with professional help. Learn more about your options for a Denied Disability Claim and the Disability Appeal Process.

The Four Levels of Appeal

The Social Security Disability Insurance appeals process has four levels:

- Reconsideration: Your file is reviewed by a new examiner. You can submit new evidence, but most reconsiderations are also denied. It is a required step to proceed.

- Hearing by an Administrative Law Judge (ALJ): This is your best opportunity for approval. You can testify in person, present your case, and have an attorney question experts. Applicants with legal representation at this stage are significantly more likely to win their case.

- Review by the Appeals Council: If the ALJ denies your claim, you can ask the Appeals Council to review the decision for legal errors. The Council can approve your claim, deny it, or send it back to an ALJ for another hearing.

- Federal Court Review: The final step is to file a lawsuit in federal district court. This is a complex legal process that requires an experienced disability attorney to argue that the SSA’s decision was not supported by law or evidence.

Navigating this process is challenging. An experienced attorney can gather evidence, prepare you for testimony, and make legal arguments on your behalf. If you’re facing an appeal, we strongly recommend seeking professional help. You can Learn how you can appeal on the SSA’s website.

Frequently Asked Questions about the SSDI Process

We know the Social Security Disability Insurance process raises many questions. Here are answers to some of the most common ones.

How long does the SSDI application process typically take?

Patience is essential. An initial application typically takes three to six months for a decision. The SSA’s “Compassionate Allowances” program can expedite claims for certain severe conditions in a matter of weeks.

If your claim is denied, the appeals process adds significant time. A reconsideration can take another three to six months. Waiting for a hearing before an Administrative Law Judge (ALJ) can take a year or more. The total timeline depends on the complexity of your case, the completeness of your records, and the backlog in your region.

Can I work while receiving SSDI benefits?

Yes, the SSA has “work incentives” that allow you to test your ability to return to work without immediately losing benefits. The Trial Work Period (TWP) lets you work for up to nine months (not necessarily consecutive) and earn any amount while still receiving your full SSDI check.

After the TWP, you enter a 36-month Extended Period of Eligibility (EPE). During this time, you won’t receive a benefit for any month your earnings are over the Substantial Gainful Activity (SGA) limit ($1,470 in 2023). If your earnings fall below SGA again during this period, your benefits can be reinstated without a new application.

Crucially, you must report all work and earnings to the SSA immediately to avoid overpayments. The rules are complex, so it’s wise to understand them fully before returning to work. The SSA provides detailed guidance on how returning to work could affect your eligibility.

What is the average monthly SSDI payment?

As of February 2023, the average monthly Social Security Disability Insurance benefit for a disabled worker was $1,483. However, this is just an average. Your benefit amount is not a flat rate; it is calculated based on your unique lifetime earnings record. The more you earned and paid in Social Security taxes, the higher your payment will be.

The maximum possible SSDI benefit in 2023 was $3,627 per month, but very few people qualify for this amount. For a personalized estimate based on your actual work history, we recommend using our SSDI Benefit Calculator.

Conclusion

Applying for Social Security Disability Insurance online is the most efficient way to get the benefits you need. We’ve covered the steps from checking eligibility to understanding the appeals process.

However, the process is complex, the SSA’s rules are strict, and most initial applications (nearly 70%) are denied. Having the right help can be critical. An experienced disability attorney understands what the SSA requires and how to effectively argue your case. Statistics show that applicants with legal representation are four times more likely to win their case at a hearing.

At Tort Advisor, we connect people with top-rated disability attorneys who have proven track records. Whether you are starting an application or appealing a denial, you don’t have to do it alone. The right attorney can make the difference in securing the financial support you’ve earned. For more information on how legal professionals can assist, explore SSDI Lawsuits. We are here to help you find the expertise you need.

Free Confidential Case Evaluation

Complete the short form below to get an immediate FREE case review with an expert in your specific claim. Don't wait, your case could be time sensitive to file a claim.

Related Posts

Did a North Dakota product cause harm? Understand product liability, your rights, and how to take action for defects.

Get justice for clergy abuse. Find an expert Priest abuse lawyer to navigate complex laws and hold institutions accountable.

Diagnosed with meningioma after Depo-Provera? Understand potential Depo-Provera lawsuit settlements, risks, & how to claim compensation.

Uncover the truth about uber sexual assault cases. Learn about the alarming scale, Uber's accountability, and legal options for justice.

Facing wildfire losses? Discover the best wildfire lawsuit attorneys in California to fight for your full recovery and justice.

Exposed to Roundup & diagnosed with NHL? Discover how to sue Monsanto, understand eligibility, & seek compensation. Your guide to justice.