The Complete Guide to Disability Claim Forms

Disability claim forms are the essential documents you need to apply for financial support when illness or injury prevents you from working. Whether you’re dealing with government programs like Social Security Disability Insurance (SSDI) or Canada Pension Plan (CPP) disability benefits, or filing through private insurance, the right forms are your gateway to crucial financial assistance.

Most Common Disability Claim Forms:

- SSA-16 – Application for Social Security Disability Insurance Benefits

- ISP-1151 – Canada Pension Plan Disability Benefits Application

- Claimant’s Statement – Your personal disability claim information

- Attending Physician’s Statement – Medical professional’s assessment

- Employer’s Statement – Work history and job duties verification

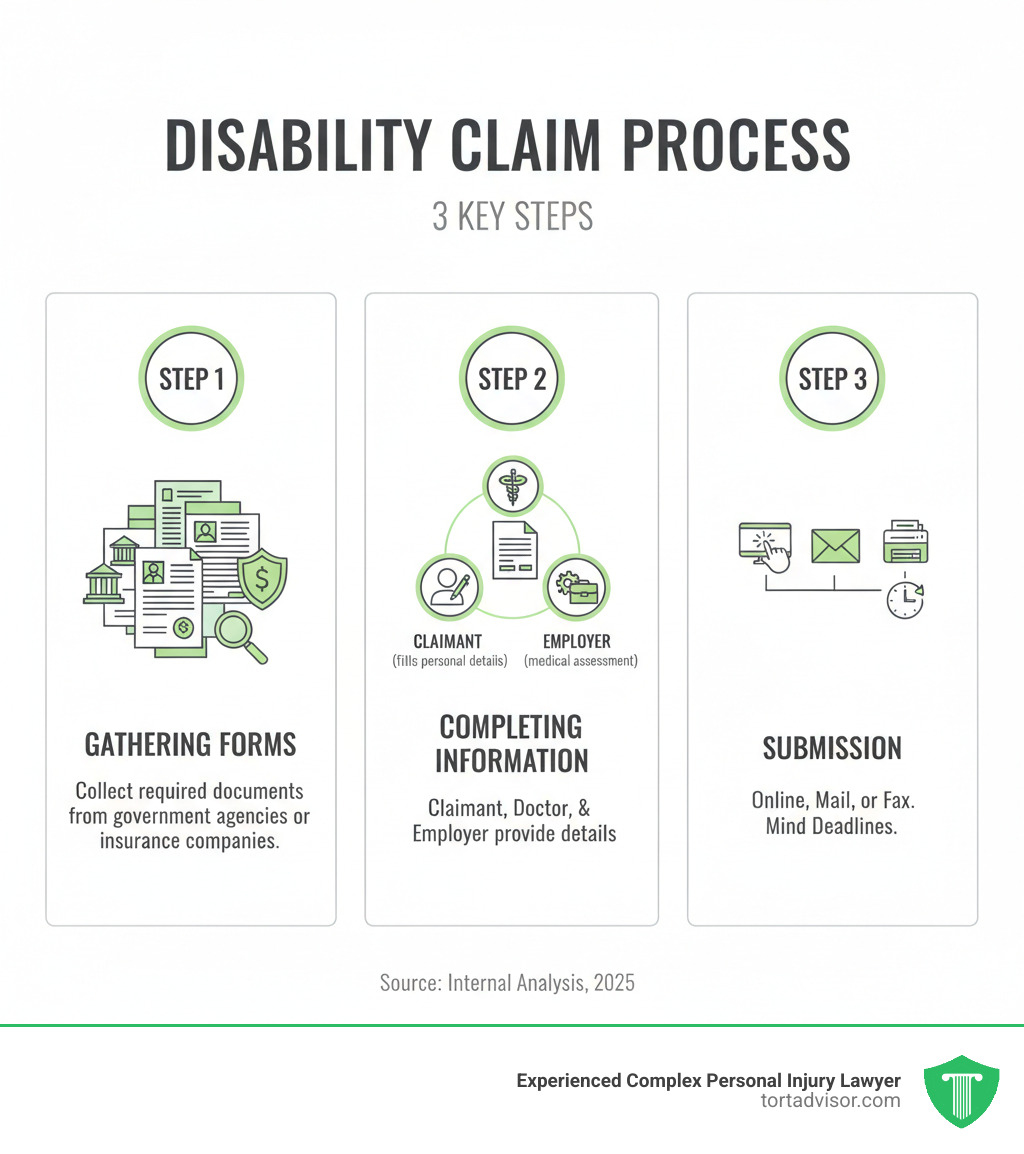

The process involves you (the claimant), your doctor, and your employer, who must all provide detailed information. Processing times vary significantly—from 120 days for typical CPP claims to just 5 business days for terminal illness applications.

Common reasons for delays include incomplete forms, insufficient medical evidence, and missing supporting documents like medical records or job descriptions. Private insurers typically require forms within 90 days of your disability date, while government programs have different timelines.

I’m Mason Arnao. My experience in data management and process automation has given me unique insights into how proper form completion can make or break your disability claim, having helped thousands of clients steer complex legal documentation.

Understanding the Different Types of Disability Claim Forms

When a disability changes everything, figuring out which forms to fill out can be overwhelming. But disability claim forms aren’t as mysterious as they seem once you understand the basics.

Disability claim forms are not interchangeable. Government programs have their own forms, as do private insurance companies. The main split is between government benefits (like Social Security Disability Insurance or Canada Pension Plan) and private insurance (short-term and long-term disability coverage).

Here’s what makes each type different:

| Feature | Government Benefits (SSDI/CPP) | Private Insurance (LTD/STD) |

|---|---|---|

| Eligibility | Must have paid into the system through taxes or contributions, plus meet strict medical criteria | Based on your specific policy terms, often starts with inability to do your current job |

| Funding Source | Your tax contributions over the years | Insurance premiums paid by you or your employer |

| Definition of Disability | Can’t do any substantial work due to severe, long-lasting condition | Usually starts as “can’t do your job,” then shifts to “can’t do any job” |

| Benefit Duration | Can last until retirement if you qualify | Short-term (weeks to months) or long-term (years, depending on policy) |

The key difference? Government programs are notoriously strict, while private insurance often starts with a more generous definition of disability before tightening up later.

Key Government Disability Claim Forms

Government disability programs are a key safety net, but they come with serious paperwork.

Social Security Disability Insurance (SSDI) is for Americans who have worked and paid Social Security taxes. The main form you’ll need is the APPLICATION FOR DISABILITY INSURANCE BENEFITS – SSA, also known as Form SSA-16-BK.

The easier route is to apply through the Social Security Administration online portal. It walks you through the process, which is helpful because SSDI has a tough definition of disability. You must prove you can’t do any substantial work due to a condition expected to last at least 12 months or result in death.

Many initial SSDI claims are denied. If that happens, don’t give up. Sometimes SSDI lawsuits become necessary to get the benefits you’ve earned.

Canada Pension Plan (CPP) Disability works similarly. If you’ve contributed to CPP and have a severe and prolonged disability, you’ll need the Application for Canada Pension Plan Disability Benefits (ISP-1151).

Canada also has an expedited process for terminal illness applications, which can be processed in days instead of months.

Common Private Insurance Disability Claim Forms

Private insurance disability claim forms typically involve three key parts to get your benefits approved.

Most private disability claims involve three key forms: the Claimant’s Statement (your story, condition’s impact, and treatment history), the Attending Physician’s Statement (medical evidence from your doctor), and the Employer’s Statement (verification of your job duties and salary from your workplace).

Both group insurance plans and individual policies follow this basic pattern, though specific forms vary by company. Employer-provided benefits can make the process smoother since HR departments are often familiar with the forms.

Many insurers now offer online tools to find the right forms, like Unum’s claim form search tool. New York Life also provides a guide on how to file a disability claim.

Always check with your specific insurer, as forms and requirements vary by company.

The Anatomy of a Claim Form: What You Need to Provide

When facing a disability, disability claim forms are your way of telling your story to decision-makers. You are building a case to show exactly how your condition has changed your life.

The process involves three key players: you as the claimant, your doctor, and your employer. Each has a specific role in painting a complete picture of your situation. If you’re self-employed, you’ll act as both claimant and employer.

Information Required from the Claimant

Your part of the disability claim forms is your chance to tell your story and help decision-makers understand your daily struggles.

Personal details like your name, address, and Social Security/Social Insurance Number are straightforward, but the next sections are more critical.

For employment history, go beyond job titles. Describe your actual duties and the specific physical and mental demands of your role. For example, instead of “office worker,” detail hours at a computer, lifting requirements, or periods of standing.

When describing your medical condition, use plain language with medical terms. Instead of just “herniated disc,” explain how the resulting pain prevents you from sitting for more than 20 minutes.

Symptoms and limitations are crucial for connecting your condition to your inability to work. Be specific. For example, “severe fatigue” becomes “I can’t concentrate for more than 30 minutes, making it impossible to complete required financial reports.”

Your treatment history should include every doctor, specialist, and clinic you’ve visited, along with dates, medications, and therapies. This shows you’re actively seeking treatment.

You’ll also need to disclose other income sources like workers’ compensation or other insurance benefits. Transparency is essential.

If you feel overwhelmed presenting your case, you might wonder if you need a personal injury lawyer. Legal professionals know how to frame these situations compellingly.

The Attending Physician’s Statement (APS)

Your doctor’s statement is the backbone of your claim. Without solid medical backing, your personal story won’t be enough. This is where objective medical evidence meets your subjective experience.

The medical diagnosis section requires your doctor to provide the official diagnosis and prognosis—what’s expected to happen with your condition over time.

Objective medical evidence like X-rays, MRIs, and blood tests separates a strong claim from a weak one. For mental health, this might include psychological evaluations.

The restrictions and limitations section is where your doctor advocates for you. They must clearly state what you cannot do and why. “Cannot lift more than 10 pounds” is much stronger than “back problems.”

Your doctor also needs to outline your treatment plan, showing the severity of your condition and your commitment to getting better.

For Canadian claims, doctors often use the Medical Report (ISP-2519) form, which has specific requirements for CPP claims.

Have an honest conversation with your doctor about your job requirements so they can advocate for you effectively.

Supporting Documents You Will Need

Beyond the main disability claim forms, you’ll need supporting documents as evidence to back up everything you and your doctor have stated.

Medical records like clinical notes and specialist consultations build your medical timeline. Lab results and imaging reports provide the objective proof adjusters look for.

You’ll need proof of age, job descriptions, and pay stubs or T4s to show your earnings history and the financial impact of your disability.

If your disability resulted from an accident, accident reports are crucial evidence. For work-related injuries, WSIB/WCB letters and correspondence about other insurance benefits should also be included.

As a self-employed person, you’ll provide tax returns, business records, and detailed work descriptions. Always keep copies of everything you submit.

Navigating the Submission and Approval Process

After gathering your disability claim forms and documents, the next step is submission and waiting for a decision, which can be the most stressful part of the process.

Understanding what to expect can ease anxiety. Knowing why delays happen helps you avoid common pitfalls.

Online vs. Paper Form Submission

You can usually submit disability claim forms online or via paper. The right choice depends on your comfort with technology and your situation.

Going digital is popular for good reason. The SSA’s option to apply online for disability benefits offers immediate confirmation and guided steps. You can also upload documents directly. The downside is you need reliable internet access. A crucial tip: if using fillable PDFs, save them to your computer first and open them with Adobe Reader XI or higher. Do not fill them out in your web browser.

Paper submission is still widely accepted. Service Canada provides instructions on how to mail the form or drop it off. The advantage is that no technology is needed. However, always use registered mail for important documents and keep copies of everything.

Typical Timelines and Common Reasons for Delays

The waiting period for a decision varies dramatically depending on the type of benefit.

For CPP disability benefits, Service Canada aims for a decision within 120 calendar days. For a terminal illness, the goal is 5 business days, and for other grave conditions, 30 calendar days.

SSDI applications typically take three to five months for an initial decision. An appeal can stretch the process over a year.

Private insurance companies often require you to submit disability claim forms within 90 days of your disability’s start date. Processing times then vary based on your case’s complexity.

Delays or denials are often caused by incomplete forms. Missing signatures, blank sections, or unanswered questions will flag your application. Insufficient medical evidence is another major issue; your records must prove your condition prevents you from working.

Other reasons for denial include earning too much money (above the “substantial gainful activity” threshold for SSDI) or failure to cooperate with information requests or recommended treatment. For government programs, your disability must be “severe and prolonged,” a high bar to meet.

If you are denied, strict deadlines apply for legal action. Don’t wait if you’re wondering how long you have to file a lawsuit.

Getting Help and Appealing a Denial

You don’t have to steer this process alone. Help is available at every stage, from initial forms to appeals. You can get assistance from family, community organizations, or professional advocates. For government benefits, you can authorize someone to communicate on your behalf using forms like the Consent to Communicate Information to an Authorized Person form (ISP-1603) for CPP.

Getting denied doesn’t mean it’s over; it’s surprisingly common, and many claims are approved on appeal. The process usually starts with reconsideration, followed by a hearing before an Administrative Law Judge, an Appeals Council review, and finally, a federal court lawsuit.

This is where asking what a personal injury lawyer can do for you becomes relevant. Experienced attorneys understand disability law, know how to gather the right evidence, and can steer the complex appeals process, significantly increasing your chances of success.

Frequently Asked Questions about Disability Claims

When dealing with disability claim forms, certain questions arise frequently. Let’s tackle the most common concerns with straight answers.

What is the difference between a “severe and prolonged” and a “terminal” disability for CPP?

This distinction can mean waiting months versus days for a decision.

A “severe and prolonged” disability is the standard CPP definition. It means your condition is long-term and regularly prevents you from doing any substantially gainful work. Think of conditions like severe arthritis or major depression. These claims typically take 120 calendar days to process.

A “terminal illness” is a condition a medical professional determines will likely result in death within 6 months. These applications are fast-tracked, with decisions aimed for within 5 business days using the specialized Terminal Illness Application form (ISP-2530A).

“Grave conditions” are rapidly progressive conditions that also get expedited processing within 30 calendar days.

What happens if I can’t work but my condition isn’t on the SSA’s “Blue Book” list?

Not being in the SSA’s “Blue Book” (Listing of Impairments) doesn’t automatically disqualify you. The Blue Book lists conditions presumed severe enough to prevent work, but it’s not the only path to approval.

If your condition isn’t listed, the SSA performs a “Residual Functional Capacity” (RFC) assessment to determine what you can still do despite your limitations. They consider your medical evidence, age, education, and work experience to see if you could transition to other work.

Your doctor’s opinion is critical here. They must clearly explain your specific limitations. The key is having strong medical documentation that paints a clear picture of what you can and cannot do. You can explore more on the SSA’s list of qualifying disorders, but your condition’s absence from the list isn’t the end of your claim.

How does a claim differ if I’m self-employed?

Being self-employed adds complexity to your disability claim forms because you must provide all the documentation an employer normally would.

You are responsible for documenting your job duties. Describe the physical and mental demands, hours worked, and how your disability prevents you from continuing.

Proving your income is also trickier. You’ll need tax returns, business records, invoices, and financial statements instead of pay stubs. Document any income decline with bank statements or client correspondence.

Demonstrating your disability’s impact might require letters from clients, evidence of lost contracts, or proof you had to turn down work. The goal is to show your disability genuinely prevents you from maintaining your self-employment.

The silver lining is that you have more control over your documentation. You can provide detailed, personalized evidence. Just be thorough and honest.

Conclusion

Navigating disability claim forms can feel like a maze, especially when you’re already dealing with a serious illness or injury. It involves deciphering government acronyms, gathering medical records, and ensuring every blank is filled correctly.

Accuracy isn’t just important—it’s everything. A missed signature, incomplete medical form, or missed deadline can derail months of work and delay the financial support you desperately need. The system demands perfection from people who are often at their most vulnerable.

Remember: you don’t have to face this alone. The process is thorough, not impossible. With the right preparation and support, thousands of people successfully secure the benefits they’ve earned.

If you’re feeling overwhelmed or your claim has been denied, that’s normal. The appeals process exists because initial denials are common; it doesn’t mean your case lacks merit. Sometimes you just need someone who speaks the language of disability law to tell your story effectively.

This is where professional guidance becomes invaluable. Tort Advisor connects individuals with experienced attorneys who specialize in these exact challenges. They are specialists who understand the nuances of disability claim forms, know which medical evidence carries the most weight, and have successfully fought for benefits in cases just like yours.

Whether you’re just starting or dealing with a denial, an expert in your corner can transform a frustrating ordeal into a manageable process. They know how to present your case, gather the right evidence, and steer the appeals system with confidence.

Don’t let complex paperwork stand between you and the financial security you need. Find help with your SSDI lawsuit today and take the first step toward getting the support you deserve.

Free Confidential Case Evaluation

Complete the short form below to get an immediate FREE case review with an expert in your specific claim. Don't wait, your case could be time sensitive to file a claim.

Related Posts

Did a North Dakota product cause harm? Understand product liability, your rights, and how to take action for defects.

Get justice for clergy abuse. Find an expert Priest abuse lawyer to navigate complex laws and hold institutions accountable.

Diagnosed with meningioma after Depo-Provera? Understand potential Depo-Provera lawsuit settlements, risks, & how to claim compensation.

Uncover the truth about uber sexual assault cases. Learn about the alarming scale, Uber's accountability, and legal options for justice.

Facing wildfire losses? Discover the best wildfire lawsuit attorneys in California to fight for your full recovery and justice.

Exposed to Roundup & diagnosed with NHL? Discover how to sue Monsanto, understand eligibility, & seek compensation. Your guide to justice.