Understanding the Tax Implications of Your Disability Benefits

Understanding disability benefits tax rules is crucial for financial planning when you’re unable to work. The last thing you need while recovering is an unexpected tax bill. Whether your benefits are taxable depends on the type of benefit and who paid for the policy.

Quick Answer: Are Your Disability Benefits Taxable?

| Type of Disability Benefit | Generally Taxable? | Key Factor |

|---|---|---|

| Private Disability Insurance (Employer-Paid Premiums) | Yes | Employer paid with pre-tax dollars |

| Private Disability Insurance (Employee-Paid Premiums) | No | You paid with after-tax dollars |

| Social Security Disability Insurance (SSDI) | Sometimes | Depends on total income |

| Supplemental Security Income (SSI) | No | Needs-based program |

| Workers’ Compensation | No | Compensation for work injury |

| VA Disability Benefits | No | Service-connected benefits |

Many are surprised to learn that some benefits are taxed while others are not. For instance, long-term disability (LTD) benefits from an employer-paid policy are usually taxable. In contrast, benefits from a policy you paid for with after-tax money are typically tax-free.

The situation can get more complex if you receive multiple benefits, like LTD and Social Security Disability Insurance (SSDI), as this can affect your total tax liability. This guide will help you understand the key rules for reporting and compliance.

Key Disability benefits tax vocabulary:

- Disability benefits application

- Disability claim assistance

- Disability appeal process

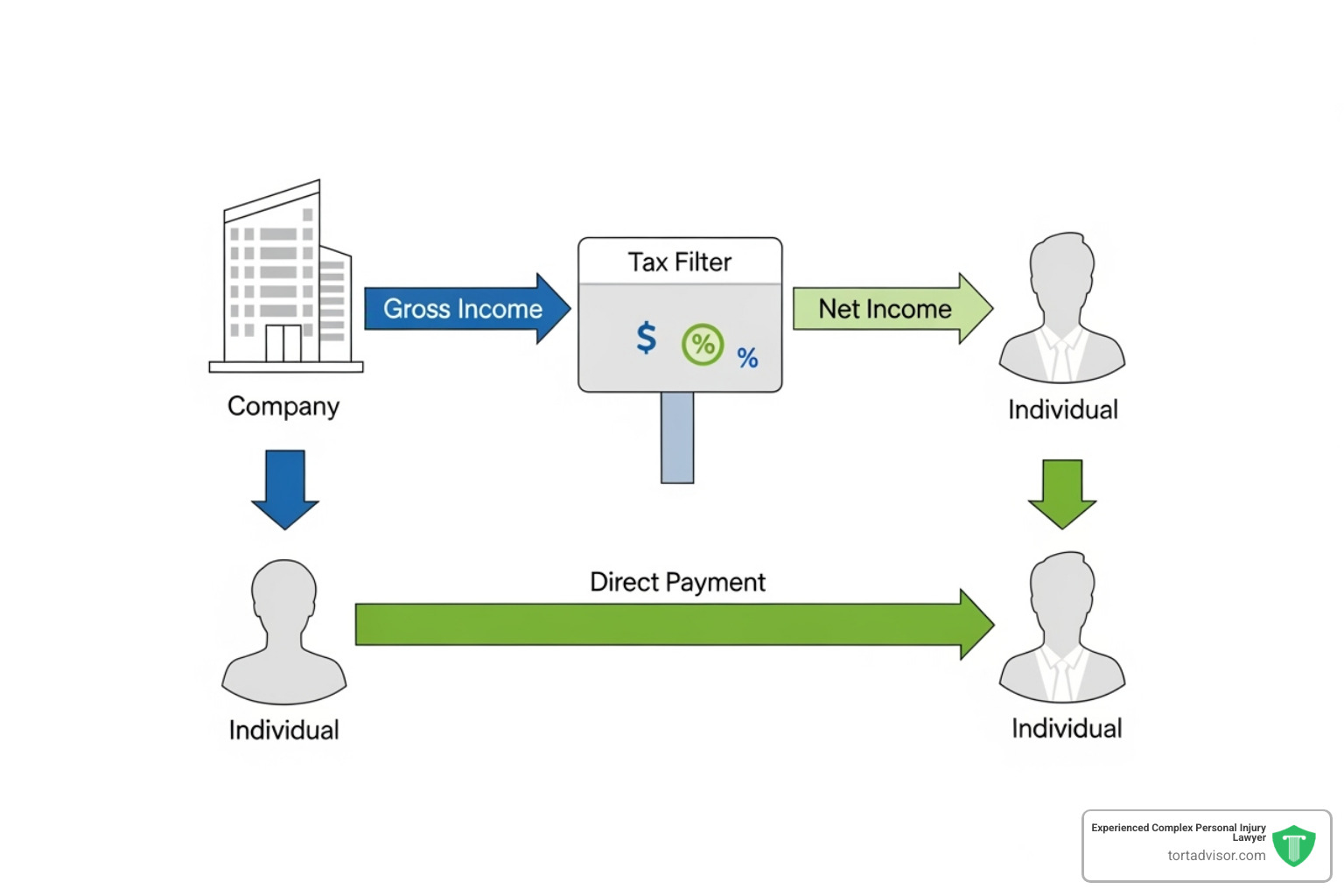

The Golden Rule of Private Disability Insurance: Who Paid the Premiums?

For private disability insurance, the tax rules are straightforward and hinge on one question: who paid the premiums? This “golden rule” applies to both Long-Term Disability (LTD) and Short-Term Disability (STD) plans. The IRS avoids double taxation; if you paid premiums with after-tax money, your benefits are tax-free. If premiums were paid with pre-tax money (usually by an employer), the benefits are taxable.

Employer-Paid Plans

If your employer pays 100% of your disability insurance premiums with pre-tax dollars, the benefits you receive are considered taxable income. This is because you never paid taxes on the money used for the premiums. These benefits are treated like wages and will be reported on your W-2, adding to your total taxable income for the year.

Employee-Paid Plans

If you paid 100% of the premiums yourself using after-tax dollars, your benefits are generally not taxable. This applies to individual policies you buy directly or some employer-sponsored plans where you pay the full premium with after-tax payroll deductions. Receiving these benefits tax-free provides crucial financial stability while you recover.

Cost-Shared Plans

In plans where you and your employer split the premium costs, your benefits are partially taxable. The taxability is pro-rated based on the contribution percentage. For example, if your employer paid 70% of the premium and you paid 30% with after-tax money, then 70% of your benefits are taxable, and 30% are tax-free. Keep records of your contribution percentage to accurately calculate your disability benefits tax liability.

Taxability of Federal and State Disability Programs

Beyond private insurance, many people rely on government programs for support. The tax rules for these federal and state benefits often differ from private plans.

Is Social Security Disability Insurance (SSDI) Taxable?

Social Security Disability Insurance (SSDI) benefits are sometimes taxable, depending on your total income. The SSA uses “provisional income” to determine this. To calculate it, add your adjusted gross income (AGI), any tax-exempt interest, and half of your Social Security benefits.

- Individuals: Up to 50% of benefits may be taxable if provisional income is between $25,000 and $34,000. Up to 85% is taxable above $34,000.

- Married Filing Jointly: The thresholds are $32,000 to $44,000 (for 50%) and above $44,000 (for 85%).

- Married Filing Separately: If you lived with your spouse, up to 85% of your benefits may be taxable regardless of income.

You will receive Form SSA-1099, which shows your total benefits received for tax filing.

Is Supplemental Security Income (SSI) Taxable?

Supplemental Security Income (SSI) benefits are not taxable. SSI is a needs-based program for those with limited income and resources, so the IRS does not consider these payments taxable income. If SSI is your only income, you likely won’t need to file a tax return.

The Tax Implications of Workers’ Compensation

Workers’ Compensation benefits are generally tax-exempt. Payments for an occupational injury or illness are not subject to federal income tax. However, a complication can arise if you also receive SSDI. If your combined benefits are too high, your SSDI payments may be reduced (an SSDI offset). The portion of your SSDI benefits that is offset by workers’ comp might become taxable. This interaction is complex, so consulting a tax professional is wise if you’re in this situation.

Are Veterans (VA) Disability Benefits Taxable?

VA disability benefits are completely tax-free. Compensation for service-connected injuries, pensions, and other VA disability payments are not considered taxable income and do not need to be reported on your tax return. It’s one less thing to worry about as you focus on your well-being.

Navigating the Complexities of Disability Benefits Tax

Real-life situations often involve complexities beyond the basic rules. Here are some trickier scenarios you might encounter and what they mean for your disability benefits tax liability.

State-Level Disability Benefits Tax Rules

Federal tax rules are only the beginning; state and provincial laws can differ. For example, in Canada, the Canada Disability Benefit interacts differently with provincial support in Alberta than elsewhere. In the U.S., states like California’s State Disability Insurance (SDI) and New Jersey’s Temporary Disability Benefits (TDB) have their own tax rules. Some states tax benefits the IRS doesn’t, while others offer breaks on federally taxed benefits. Always check your state’s department of revenue website or consult a local tax professional.

How Receiving Multiple Benefits Affects Your Disability Benefits Tax

Receiving benefits from multiple sources, like a private LTD policy and SSDI, can complicate your tax situation due to offset provisions. Many LTD policies reduce your payment if you also receive government benefits. For example, if your LTD insurer reduces your payment because you started receiving taxable SSDI or CPP Disability benefits, your total income may not change, but your tax liability will. The government portion is now taxable, which can be an unwelcome surprise. Understanding this coordination of benefits is essential for accurate tax planning.

Understanding Your Disability Benefits Tax on Lump-Sum Settlements

The tax treatment of a lump-sum settlement depends on what the payment is for. Settlements for physical injuries or illnesses are typically non-taxable, including compensation for medical bills and pain and suffering. However, punitive damages and any interest earned on the settlement are generally taxable. The allocation of funds in your settlement agreement is critical. For example, workers’ compensation lump-sum settlements are usually tax-exempt, but their interaction with SSDI can have tax consequences. It is crucial to have an attorney and tax professional review any settlement agreement before you sign.

Strategies to Reduce Your Tax Burden

Several strategies can help lower your tax burden on disability benefits. Taking advantage of deductions, credits, and specialized savings accounts can make a significant financial difference.

The Medical Expense Deduction

Significant medical costs related to your disability may be deductible.

- In the United States, you can deduct qualified medical expenses that exceed 7.5% of your Adjusted Gross Income (AGI) if you itemize.

- In Canada, the Medical Expense Tax Credit allows you to claim eligible, unreimbursed medical expenses to offset taxes owed.

For both, keeping detailed records and receipts is essential.

ABLE Accounts: Tax-Advantaged Savings for Disability

For U.S. residents disabled before age 26, ABLE accounts are a powerful tool. These savings accounts allow money to grow and be withdrawn tax-free for qualified disability expenses (e.g., housing, healthcare, education) without affecting eligibility for benefits like SSI or Medicaid. Contributions are limited annually, but they provide a way to build savings while maintaining critical support.

Other Relevant Tax Credits

Several tax credits are designed to assist individuals with disabilities and their families.

- United States: The Credit for the Elderly and the Disabled is available for low-income individuals who are over 65 or retired on permanent and total disability with taxable disability income. The Credit for Other Dependents may also apply.

- Canada: The Disability Tax Credit (DTC) is a key non-refundable credit that reduces income tax and acts as a gateway to other programs. Learn more about the Disability Tax Credit. Qualifying for the DTC may make you eligible for the Registered Disability Savings Plan (RDSP), the Child Disability Benefit, and the Canada Caregiver Credit. Learn more about RDSPs and the Child Disability Benefit.

The Canada Disability Benefit (CDB)

Launched in 2025, the Canada Disability Benefit (CDB) is a new federal, tax-free monthly payment for low-income, working-age Canadians with disabilities. Eligibility is tied to qualifying for the Disability Tax Credit (DTC). The benefit is designed to supplement existing provincial and territorial support programs, providing additional financial security without increasing your disability benefits tax burden.

Frequently Asked Questions about Disability Taxes

Here are concise answers to the most common questions about disability benefits tax.

Do I have to pay taxes on a lump-sum disability settlement?

The taxability of a lump-sum settlement depends on what the payment is for. Generally, settlements for physical injury or illness (covering medical costs, lost wages, pain and suffering) are not taxable. However, portions of a settlement allocated to punitive damages or interest are typically taxable. For this reason, the specific wording in your settlement agreement is critical. Always have a legal and tax professional review the agreement.

How do I report taxable disability benefits on my tax return?

Taxable disability benefits are reported using forms sent by the paying agency.

- SSDI: You’ll receive Form SSA-1099. You report the taxable portion on your Form 1040.

- Private LTD: Taxable benefits are often reported on a W-2 form from your employer or insurer.

- CPP Disability (Canada): You’ll receive a T4A slip and report the income on your Canadian tax return.

Keep all tax forms you receive in a safe place for filing.

Can I have taxes withheld from my disability payments?

Yes, and it’s a wise strategy to avoid a large tax bill at year-end.

- U.S. Social Security: File Form W-4V with the Social Security Administration to have a percentage of your benefits withheld.

- Private LTD: Contact the insurance company directly to arrange for tax withholding.

- Canadian CPP Disability: Submit Form ISP3520 to Service Canada.

Withholding taxes helps you manage your obligations throughout the year and provides peace of mind.

Conclusion

Navigating disability benefits tax rules can be complex, but understanding the fundamentals is key to financial stability. Remember the golden rule for private insurance: who paid the premium determines taxability. For government benefits, the rules vary—SSI and VA benefits are tax-free, while SSDI can be taxable based on your income. Complexities like benefit offsets and lump-sum settlements require careful attention. Fortunately, tax-saving strategies like medical expense deductions, ABLE accounts, and various tax credits can provide significant relief.

While understanding these rules is a great first step, applying them to your unique situation can be challenging. If you’re facing a denied claim, confusing benefit coordination, or other legal issues related to your disability or personal injury, professional guidance is invaluable. Tort Advisor connects clients with experienced attorneys who specialize in these exact challenges.

Whether you’re dealing with a disability claim issue or another personal injury matter, we have resources to help:

- SSDI Iowa Ultimate Guide 2025

- Disability Appeal Forms Complete Guide

- Denied Disability Claim

- SSDI Reconsideration Appeal

- SSDI Lawsuits

- How to Claim Social Security Disability Insurance Arkansas

We also connect clients with attorneys handling various other legal matters, from car accident lawsuits and workplace sexual harassment to product liability cases like Ozempic lawsuits, Roundup lawsuits, and NEC baby formula lawsuits. We work with attorneys experienced in asbestos lawsuits, hernia mesh lawsuits, hair relaxer lawsuits, breast implant lawsuits, Suboxone lawsuits, Paraquat lawsuits, PFAS cancer lawsuits, Depo-Provera lawsuits, Bair Hugger lawsuits, and mesothelioma lawsuits. We also handle sensitive cases involving child sexual abuse, teacher sexual abuse, church or religious organization sexual abuse, athlete sexual abuse, university sexual assault, wildfire lawsuits, and even video game addiction lawsuits.

Being proactive about your tax planning and seeking professional advice when needed can save you money and stress. If you need support, don’t hesitate to reach out to a qualified professional for personalized guidance.

Free Confidential Case Evaluation

Complete the short form below to get an immediate FREE case review with an expert in your specific claim. Don't wait, your case could be time sensitive to file a claim.

Related Posts

Did a North Dakota product cause harm? Understand product liability, your rights, and how to take action for defects.

Get justice for clergy abuse. Find an expert Priest abuse lawyer to navigate complex laws and hold institutions accountable.

Diagnosed with meningioma after Depo-Provera? Understand potential Depo-Provera lawsuit settlements, risks, & how to claim compensation.

Uncover the truth about uber sexual assault cases. Learn about the alarming scale, Uber's accountability, and legal options for justice.

Facing wildfire losses? Discover the best wildfire lawsuit attorneys in California to fight for your full recovery and justice.

Exposed to Roundup & diagnosed with NHL? Discover how to sue Monsanto, understand eligibility, & seek compensation. Your guide to justice.